REDMOND, Wash. — July 22, 2014 — Microsoft Corp. today announced revenue of $23.38 billion for the quarter ended June 30, 2014. Gross margin, operating income, and diluted earnings per share (“EPS”) for the quarter were $15.79 billion, $6.48 billion, and $0.55 per share, respectively.

Microsoft completed the acquisition of substantially all of the Nokia Devices and Services (“NDS”) business on April 25, 2014. Revenue and cost of revenue from the acquired business, including amortization of intangible assets, are reported in the new Phone Hardware segment. For the fourth quarter and fiscal year 2014, the results of NDS contributed revenue, gross margin, operating income, and diluted EPS of $1.99 billion, $54 million, $(692) million, and $(0.08), respectively.

“We are galvanized around our core as a productivity and platform company for the mobile-first and cloud-first world, and we are driving growth with disciplined decisions, bold innovation, and focused execution,” said Satya Nadella, chief executive officer of Microsoft. “I’m proud that our aggressive move to the cloud is paying off – our commercial cloud revenue doubled again this year to a $4.4 billion annual run rate.”

“Our solid execution and expense discipline allowed us to deliver a strong finish to the fiscal year,” said Amy Hood, executive vice president and chief financial officer at Microsoft. “As we enter fiscal 2015, we are focused on aligning our resources to strategic investments that we believe will deliver the next wave of innovation, growth, and long-term shareholder value.”

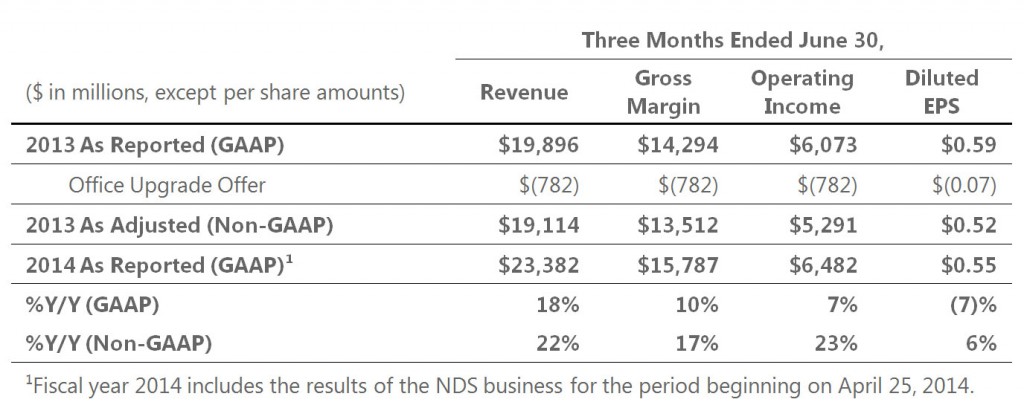

The following table reconciles these financial results reported in accordance with generally accepted accounting principles (“GAAP”) to Non-GAAP financial results. We have provided this Non-GAAP financial information to aid investors in better understanding the company’s performance. All growth comparisons relate to the corresponding period in the last fiscal year. Additionally, we note below certain operational items that also impacted the company’s financial performance (“Noted Items”). Noted Items and the Non-GAAP measures are defined following the financial tables and highlights.

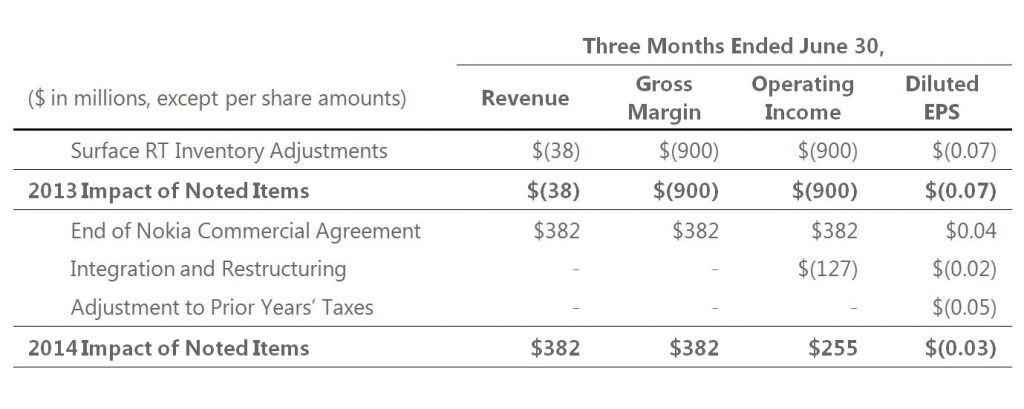

Additionally, we note below certain operational items that also impacted the company’s financial performance (“Noted Items”). Noted Items and the Non-GAAP measures are defined following the financial tables and highlights.

Devices and Consumer revenue grew 42% to $10.00 billion, with the following business highlights:

Devices and Consumer revenue grew 42% to $10.00 billion, with the following business highlights:

- Windows OEM revenue grew 3%, driven by 11% growth in Windows OEM Pro revenue.

- Office 365 Home and Personal subscribers totaled more than 5.6 million, adding more than 1 million subscribers again this quarter.

- The acquired Phone Hardware business contributed $1.99 billion to current year revenue.

- Bing search advertising revenue grew 40%, and U.S. search share grew to 19.2%.

Commercial revenue grew 11% to $13.48 billion, with the following business highlights:

- Commercial cloud revenue grew 147% with an annualized run rate that exceeds $4.4 billion.

- Windows volume licensing revenue grew 11%.

- Server products revenue, including Azure, grew 16%, with double-digit growth for SQL Server and System Center.

“Our results reflect our customers’ long-term commitments to our products and services, and strong execution by our field teams. We are thrilled with the tremendous momentum of our cloud offerings with Office 365 and Azure both growing over 100% again,” said Kevin Turner, chief operating officer at Microsoft. “Looking forward, we are excited by the amazing opportunities enabled by our technology roadmap and our strong engagement across partners, customers, and developers.”

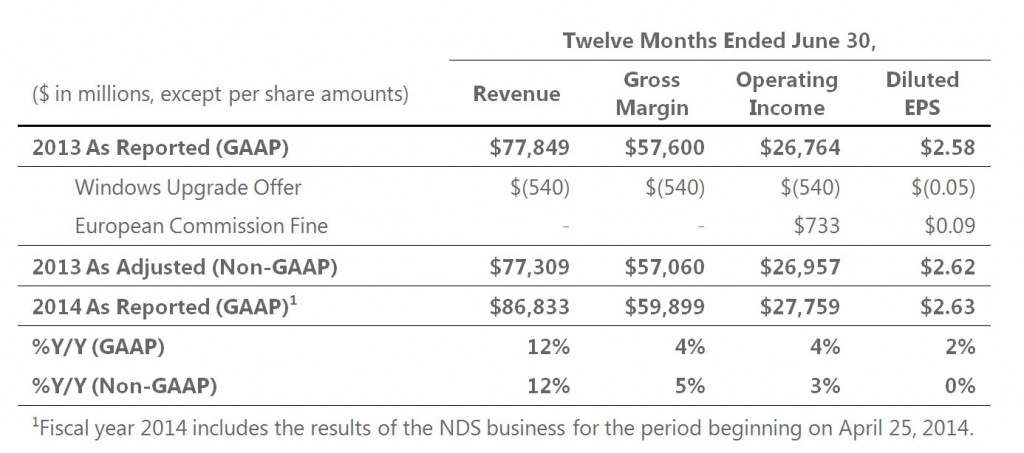

For Microsoft’s fiscal year 2014, the company’s revenue, gross margin, operating income, and diluted EPS were $86.83 billion, $59.90 billion, $27.76 billion, and $2.63 per share, respectively.

The following table reconciles these financial results reported in accordance with GAAP to Non-GAAP financial results. We have provided this Non-GAAP financial information to aid investors in better understanding the company’s performance.

The impact of Noted Items on the financial results was the same for the fourth quarter and for fiscal year 2014.

The impact of Noted Items on the financial results was the same for the fourth quarter and for fiscal year 2014.

Business Outlook

Microsoft will provide forward-looking guidance in connection with this quarterly earnings announcement on its earnings conference call and webcast.

On July 17, 2014, Microsoft announced a restructuring plan to streamline and simplify its operations and align the recently acquired NDS business with the company’s overall strategy. The pre-tax costs associated with this plan are estimated to be between $1.1 billion and $1.6 billion and will be recorded in fiscal year 2015, substantially in the first half of the fiscal year.

Webcast Details

Satya Nadella, chief executive officer, Amy Hood, executive vice president and chief financial officer, Frank Brod, chief accounting officer, John Seethoff, deputy general counsel, and Chris Suh, general manager of Investor Relations, will host a conference call and webcast at 2:30 p.m. PDT (5:30 p.m. EDT) today to discuss details of the company’s performance for the quarter and certain forward-looking information. The session may be accessed at http://www.microsoft.com/investor/. The webcast will be available for replay through the close of business on July 22, 2015.

Adjusted Financial Results and Non-GAAP Measures

During the fourth quarter of fiscal year 2013, GAAP revenue, gross margin, operating income, and diluted EPS included the recognition of previously deferred revenue for the Office Upgrade Offer. For fiscal year 2013, the financial results included the recognition of previously deferred revenue related to the Windows Upgrade Offer as well as the European Commission Fine. These items are defined below. In addition to these financial results reported in accordance with GAAP, we have provided certain Non-GAAP financial information to aid investors in better understanding the company’s performance. Presenting these measures without the impact of these items gives additional insight into operational performance and helps clarify trends affecting the company’s business. For comparability of reporting, management considers this information in conjunction with GAAP amounts in evaluating business performance. These Non-GAAP financial measures should not be considered as a substitute for, or superior to, the measures of financial performance prepared in accordance with GAAP.

Non-GAAP Definitions

Revenue recognition of $782 million in the fourth quarter of fiscal year 2013 related to the revenue deferred on sales of the previous version of the Microsoft Office system with a guarantee to be upgraded to the new Office at minimal or no cost (“Office Upgrade Offer”).

Revenue recognition of $540 million in fiscal year 2013 related to the revenue deferred on sales of Windows 7 with an option to upgrade to Windows 8 Pro at a discounted price (“Windows Upgrade Offer”).

Fine of €561 million ($733 million) assessed by the European Commission in the third quarter of fiscal year 2013 for violation of an order to provide a browser choice screen with Internet Explorer on PCs sold in Europe (“European Commission Fine”).

Noted Items Definitions

Charge of $900 million recorded in the fourth quarter of fiscal year 2013 for Surface RT Inventory Adjustments (“Surface RT Inventory Adjustments”).

Revenue recognition of $382 million in the fourth quarter of fiscal year 2014 from the contractual relationship between Nokia and Microsoft related to joint strategic initiatives which was terminated in conjunction with the acquisition of substantially all of the NDS business (“End of Nokia Commercial Agreement”).

Expenses of $127 million in the fourth quarter of fiscal year 2014 associated with the acquisition and integration of NDS. These expenses consist of transaction fees and direct acquisition costs, including legal, finance, consulting and other professional fees. These costs also include employee compensation and termination costs associated with certain reorganization activities (“Integration and Restructuring”).

Tax provision adjustment of $458 million, or a $(0.05) per share impact, in the fourth quarter of fiscal 2014 related to adjustments to prior years’ liabilities for intercompany transfer pricing that increased taxable income in more highly taxed jurisdictions (“Adjustment to Prior Years’ Taxes”).

About Microsoft

Founded in 1975, Microsoft (Nasdaq “MSFT”) is the worldwide leader in software, services, devices and solutions that help people and businesses realize their full potential.

Forward-Looking Statements

Statements in this release that are “forward-looking statements” are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors such as:

- intense competition in all of Microsoft’s markets;

- increasing focus on services presents execution and competitive risks;

- significant investments in new products and services that may not be profitable;

- acquisitions, joint ventures, and strategic alliances may have an adverse effect on our business;

- impairment of goodwill or amortizable intangible assets causing a significant charge to earnings;

- Microsoft’s continued ability to protect its intellectual property rights;

- claims that Microsoft has infringed the intellectual property rights of others;

- the possibility of unauthorized disclosure of significant portions of Microsoft’s source code;

- cyber-attacks and security vulnerabilities in Microsoft products that could reduce revenue or lead to liability;

- disclosure of personal data that could cause liability and harm to Microsoft’s reputation;

- outages, data losses, and disruptions of our online services if we fail to maintain an adequate operations infrastructure;

- government litigation and regulation that may limit how Microsoft designs and markets its products;

- potential liability under trade protection and anti-corruption laws resulting from our international operations;

- Microsoft’s ability to attract and retain talented employees;

- adverse results in legal disputes;

- unanticipated tax liabilities;

- our hardware and software products may experience quality or supply problems;

- exposure to increased economic and operational uncertainties from operating a global business;

- catastrophic events or geo-political conditions may disrupt our business; and

- adverse economic or market conditions may harm our business.

For more information about risks and uncertainties associated with Microsoft’s business, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of Microsoft’s SEC filings, including, but not limited to, its annual report on Form 10-K and quarterly reports on Form 10-Q, copies of which may be obtained by contacting Microsoft’s Investor Relations department at (800) 285-7772 or at Microsoft’s Investor Relations website at http://www.microsoft.com/investor/.

All information in this release is as of July 22, 2014. The company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the company’s expectations.

For more information, financial analysts and investors only:

Chris Suh, general manager, Investor Relations, (425) 706-4400

Note to editors: For more information, news and perspectives from Microsoft, please visit the Microsoft News Center at http://www.microsoft.com/news/. Web links, telephone numbers, and titles were correct at time of publication, but may since have changed. Shareholder and financial information, as well as today’s 2:30 p.m. PDT conference call with investors and analysts, is available at http://www.microsoft.com/investor/.