Small businesses are the lifeblood of New Zealand’s economy, but it’s hard to go at it alone. When the founders of technology business 9 Spokes realised smaller companies weren’t getting access to the right tools to succeed, they set out to help the little guy. Now through a strong tech partnership with Microsoft, they’re championing SMEs the world over.

When it comes to the corporate power struggle, small businesses are often treated like a younger sibling. If anything, small businesses work harder, are more creative and innovative and often achieve more with less. They can get left behind in the race for new technologies and generally have to shout to be heard. Yet, small businesses make up such a large portion of every nation’s economy. According to the Ministry of Business, Innovation and Employment, they represent more than 97% of New Zealand businesses. So why are they often overlooked by larger corporates, consumers and even technology companies?

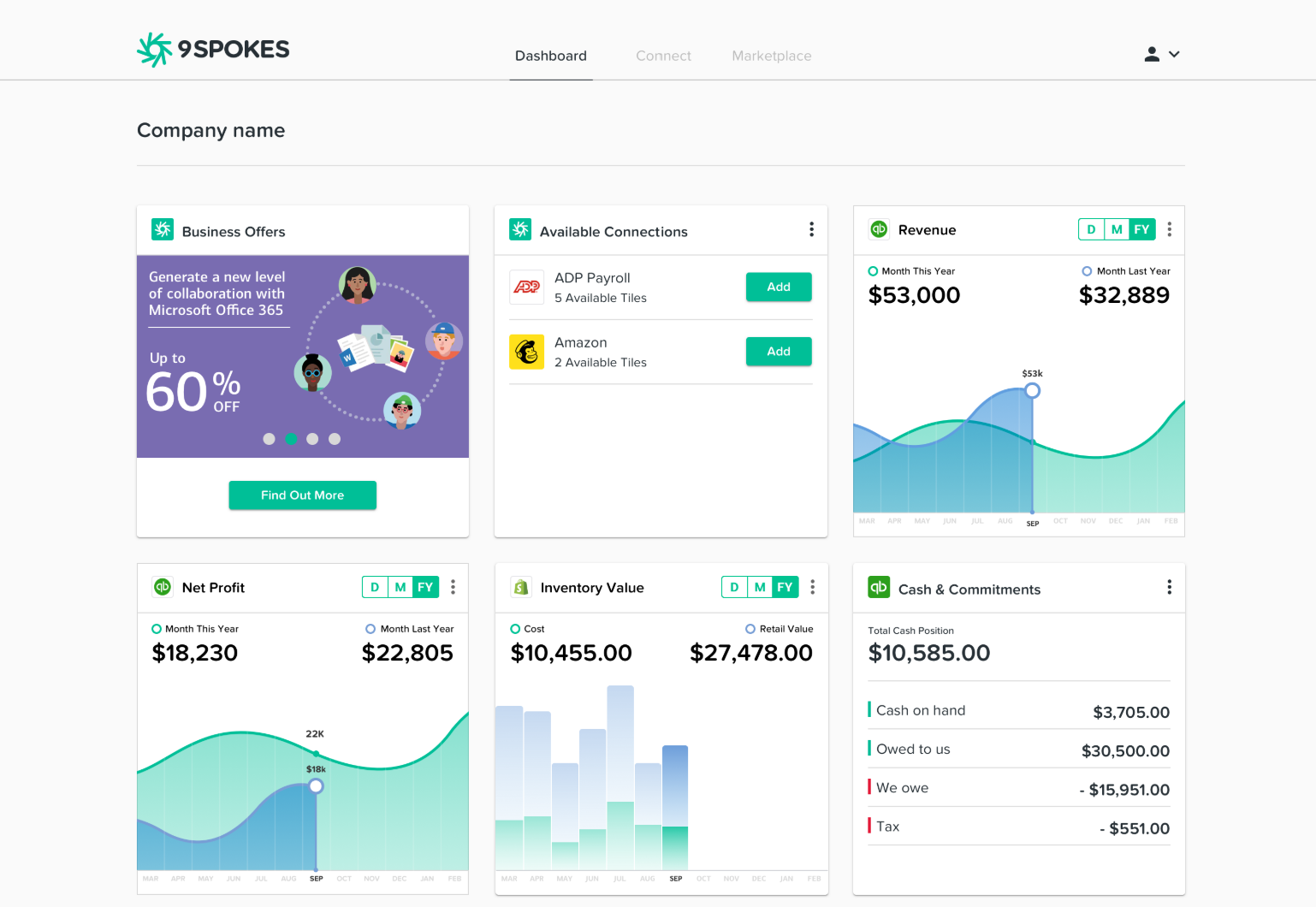

For Mark Estall and Adrian Grant, the co-founders of 9 Spokes, the idea of small businesses only having access to substandard technology and minimal business insights, didn’t sit right. So, they set out to build a technology business that gave small businesses access to the best apps, analytics and growth resources all in one place. Through its platform, 9 Spokes wanted to deliver value to SMEs that had not been available before, ensuring they could manage and grow their business with confidence.

Jesper Peterson, Chief Technology Officer at 9 Spokes, explains:

“Small businesses use lots of different tools to deliver services to customers – whether it’s an accounting package, Outlook, Mailchimp, web analytics, Office 365, payroll software or software to monitor and manage HR – it can all be incredibly overwhelming for them and hard to manage. Big corporates can afford to pay teams of people to not only manage these different platforms, but also compile reports to provide insights on what’s working and what isn’t – small businesses just don’t have this bandwidth.”

“9 Spokes was created because Mark and Adrian thought, ‘How do we pull this all together for small businesses, including analytics that will help them scale with confidence?’” he says.

Co-sell partnership brings the “trifecta”

In 2012 the team set out to build a dashboard capable of integrating with different apps and services to provide businesses access to the tools and insights they needed in one location.

They also built an online app Marketplace to facilitate connections between third-party app developers and small business customers. Marketplace opened up an additional revenue stream and helped 9 Spokes to grow its customer base further.

However, things didn’t exactly start the way they wanted and they quickly realised that, while 9 Spokes first technology partner had some good solutions, they just weren’t right for what the business was trying to achieve.

“We realised that if we wanted to take ourselves to the next level for our customers, we had to move it to the cloud and we just weren’t set up for that,” says Jesper.

“So we looked at the different cloud providers and, while other technology stacks competed in terms of performance and features, Microsoft was the only business that could offer us a strong and established co-sell partnership. We also wanted to sell Office 365 in our Marketplace, so it was win-win situation. In the end, we partnered with Microsoft because we got the trifecta – the Azure Cloud Stack, the co-sell partnership, and we could offer Office 365 to customers.”

While 9 Spokes had global reach from the early days, the co-sell agreement now in place provides the baseline structure and market confidence needed to boost uptake even further.

Reaching the right customers

Much of 9 Spokes’ SME client base is through large banks, which is a departure from years past.

As Jesper explains: “Banks recognise the small business sector was overlooked in the past, and they’re now focusing on this essential part of the economy.”

“The banking sector is facing incredible disruption. The advent of peer-to-peer lending as well as the creation of new forms of currency like crypto currency is forcing the banking sector to look hard at how it can better serve customers. The 9 Spokes solution is integral for these banks who are looking for ways to provide value added services, and drive better engagement.”

It’s been this work with banks that has enabled 9 Spokes to achieve real scale, signing partnership deals with Bank of New Zealand, Bank of America and OCBC Bank in Singapore.

“Bank of America alone has millions of small business customers so, by partnering with them, we are able to reach so many more business owners than if we were selling our platform ourselves. By making one connection, we make connections with millions of businesses and help them on their journey,” Jesper says.

However, focusing on the financial sector also has its challenges.

“The regulatory environment and expectations around compliance are really high, we have to ensure our platform ticks all the right boxes. Banks have to ensure the data they share is safe and secure, and there is minimal risk associated with the technology.”

Why they’re banking on Azure

Once 9 Spokes made the switch to Microsoft, the improvements were immediate.

“Having DevOps feed into Azure makes it easy for us to release new software. We love it because our dev guys can create containers in Azure Kubanetics (AKS) in real-time, then they can replace the front end, test it with traffic and switch off the old version without downtime and disruptions to customers.”

Through AKS, 9 Spokes can run different containers on virtual machines. It means they can put clients into different containers in the cloud, which means there is no risk of mixing up data, and it’s much safer and more secure. Banks like this from a compliance point of view and because it’s at a minimal cost.

The switch to Azure also freed 9 Spokes from more mundane compliance tasks; members of staff were redeployed to value-add parts of the business – such as creating new tools and apps.

“We had two guys working full time monitoring scripts, which was a huge waste of resource. We’ve been able to redeploy those people to other parts of the business. The technology team is doing far more these days with far fewer people,” Jesper says.

“From a dev perspective, we now manage our pipeline through Azure DevOps, then we manage the workflow via Teams, and we deploy any new tools and services via DevOps as well. It’s made the process as seamless as it can be.”

Next up: delivering to small businesses around the globe

Now that 9 Spokes has migrated to Microsoft Azure and co-sell is a rousing success, the focus is on what’s next.

“There is still a lot of platform to be built – we have so many different features and benefits we want to deliver to small businesses around the globe. It used to take us six months to deploy a new tool or feature for our banking customers. Now we’re using Azure it only takes a few weeks,” Jesper says.