Business leaders in Asia Pacific’s Financial Services Industry (FSI) are embracing the 4th Industrial Revolution, according to a Microsoft Study. 81% of them believe that they need to transform to a digital business to enable future growth but only 31% said that they have a full digital strategy in place today. These are some of the key findings of the Microsoft Asia Digital Transformation Survey[1], commissioned to understand how business leaders in FSI organisations are embracing the digital era.

81% respondents agreed that cloud computing is now an essential part of their digital transformation strategy, and same percentage of respondents agreed that new data insights can lead to new revenue streams.

Technology advancements have ushered in the 4th Industrial Revolution, where cutting-edge technologies such as Internet of Things (IoT), artificial intelligence (AI), advanced data analytics, and mixed reality are powered by cloud computing to create limitless possibilities in transforming the way people work, live and play. This revolution, together with rapid urbanisation, emergence of the millennial workforce and a fragile global economic climate, is ushering societal and economic changes at an unprecedented pace.

The Microsoft Asia Digital Transformation Study surveyed 1,494 business leaders across five industries from Asia Pacific working in organisations with more than 250 employees from 13 Asia Pacific markets: Australia, China, Hong Kong, Indonesia, India, Japan, Korea, Malaysia, New Zealand, Philippines, Singapore, Taiwan and Thailand. All respondents were pre-qualified as being involved in shaping their organisations’ digital strategy. Among them, 335 respondents were from the Financial Services Industry.

[Infographic: Is Asia’s Financial Services Industry Ready for Digital Disruption?]

Even as majority of business leaders are aware of the urgent need to transform digitally to address the changing business climate, the study found that the transformation journey for most organisations in Asia Pacific is still at its infancy. In fact, only 31% of business leaders indicated that they have a full digital transformation strategy in place and 53% are in progress with specific digital transformation initiatives for selected parts of their business. 16% still have very limited or no strategy in place.

According to Capgemini’s World Retail Banking Report, 15% of banking customers are likely to leave their banks due to ease of use and service levels; and banks have to do more to transition customers from physical branches to digital channels. In addition, Avanade found that 80% consider personalised services as a key driver for customers to switch insurers.

Andrés Ortola, Director of the Enterprise and Partners Group, Microsoft Singapore, said: “The Microsoft Asia Digital Transformation Study has shown that FSI players have started to act on the need for digital transformation to address the challenges and opportunities of the 4th Industrial Revolution in the region. However, these organisations are not acting fast enough to capitalise on the value of generating greater insights from new and existing data, to better meet the needs of customers, especially personalised offerings and expansion into digital channels. We urge all business leaders in this space to take steps to re-think how their organisation would look like as a digital business to stay relevant.”

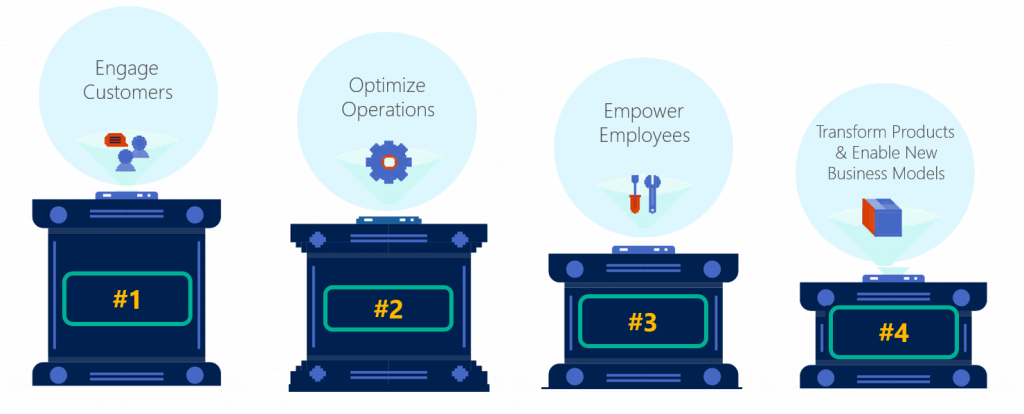

“At Microsoft, we believe this involves transformation in four key pillars – empowering employees, engaging customers, optimising operations and transform with new products, services or business models, and data and the cloud are key enablers of these.”

Clear Priorities for Digital Transformation but True Transformation Lacking

Microsoft has defined what it means to transform in four key pillars:

- Engage customers: Consumers are savvier than ever before, with access to data ensuring they are often educated on a product or service before engaging. FSI organisations today need to reimagine the client experience and deliver more value through insights and relevant offers by engaging clients in a natural, highly-personal and innovative ways throughout the customer journey – driving increased relevance, loyalty and profitability.

- Empower employees: The nature of how we work – and the workplace itself – has undergone a dramatic evolution. It is now crucial to empower a high-quality and committed digital workforce to work and collaborate as a team anywhere, on any device, with modern productivity tools that provide seamless access to data. This will enable organisations to innovate faster, meet compliance requirements, and deliver exceptional client experiences.

- Optimise operations: Technology disrupters such as Artificial Intelligence and IoT are accelerating the potential for businesses to optimise their operations. Organisations can gain breakthrough insight into risk and operational models with advanced analytics solutions and act on real-time intelligence to optimise risk management and meet regulatory requirements.

- Transform products & business models: The opportunity to embed software and technology directly into products and services is evolving how organisations deliver value, enabling new business models, and disrupting established markets. FSI organisations can now drive agility with open and connected systems with highly-automated digital processes to support new product development in order to optimise distribution channel strategies, while meeting the security, privacy and transparency expectations of customers, regulators and shareholders.

The Study shows how business leaders in FSI are prioritising their digital transformation strategies:

In fact, according to Capgemini, less than 50% of Gen Y customers globally are likely to remain with their primary banks, which makes customers a priority in the digital age. Said Ortola: “It is not surprising that engaging customers is top priority in the digitalisation journey. Customer insights is the new currency for FSI organisations, however, it is concerning to see that while there is widespread acknowledgement of the need to transform, they are doing so incrementally. With constant pressure from newer and more agile fintech players in Asia Pacific, the transformation of products and new revenue models provides the greatest opportunity for organisations to truly lead rather than be disrupted. Leaders need to rethink business models, find new data insights which lead to new revenue streams. And they need to do this by embracing a different way of bringing together people, data, and processes. which create value in a new digital business.”

Emerging Technologies in Demand

Cloud computing and the decreasing cost of devices have made it more affordable for organisations to transform digitally, according to 83% of FSI business leaders surveyed.

However, in the next 12 to 18 months, business leaders in Asia Pacific’s FSI space are interested to explore a range of emerging technologies to accelerate and achieve digital transformation. The top five technologies identified by business leaders as being relevant to them are:

- Internet of Things (IoT): Network of sensors embedded into devices that can collect data or be remotely controlled. Examples include IoT applications used in ATMs for predictive maintenance;

- Artificial intelligence (AI): Intelligent machines or software that can learn and perform tasks independently. These are solutions that can see, hear, speak and understand needs and emotions, using natural methods of communication which is enhanced by vast amount of data from various sources;

- Next-generation computing experiences: Computers and software that can process natural languages, gestures and visuals. Examples include chatbots and Microsoft’s Skype Translator;

- Predictive analytics: Modern cloud-based applications and tools which enable organisations to find actionable insights through data mining and predictive analytics in real time; and

- Quantum computing: Next-generation computers using different computation systems to solve data equations much faster than traditional computers.

Ortola added: “Emerging technologies, specifically, cloud, analytics and new capabilities like AI and IoT will give organisations new capability to transform. But real transformation only happens when they bring their people along with them. Equipping employees with the right tools to enable them to be part of solution to be more responsive, data driven and customer centric are also key.”

Barriers to Digital Transformation in Asia Pacific

While there is no doubt that digital transformation will bring significant benefits for both businesses and employees, the path to digital transformation has been slow, given that only 31% have a full digital strategy in place.

According to business leaders in the study, the top barriers to digital transformation in FSI are, in order of priority:

Increasing security threats in today’s digital economies is real and cannot be ignored. Cyber attack and fraud are top of mind for banks today. Banks are under continuous pressure of meeting regulatory, anti-money laundering compliance requirements, according to Morgan Stanley, there are US$280 billion paid in bank fines since 2009. There is a continued perception among business leaders that the cloud is less secure. However, they may be less privy to the advances being made in the cloud on security and privacy and need more exposure on how, with the current threat environment, it will be safer being in the cloud than relying on tradition forms of IT. In fact, a recent Microsoft Asia Pacific survey of 1,200 IT leaders [2] conducted in September 2016 found that 87% believe that in the longer term, the cloud will be safer.

“People don’t use technology that they don’t trust. This is a golden rule that applies to organisations and individuals alike as we live in a mobile-first and cloud-first world. Ensuring security, privacy, and compliance are key to enabling FSI organisations to carry out digital transformation with confidence. As such, protecting sensitive data requires a new and integrated approach, all of which we have invested in significantly,” said Ortola.

Microsoft’s mission is to empower every person and every organisation on the planet to achieve more – building technology so that others can innovate, build their own technology, and create solutions that make things happen. Microsoft is uniquely able to enable businesses of all sizes to get from where it is today, to where it needs to be as digital business through its flexible technology solutions, integrated offerings and our investment in being the most trustworthy with investments in security, privacy and control, compliance, and transparency.

To find out more about how Microsoft is enabling digital transformation for FSI organisations, visit https://enterprise.microsoft.com/en-us/industries/banking-and-capital-markets/

[1] The Microsoft Asia Digital Transformation Study was conducted between October to November 2016 involving 1,494 business leaders in 13 Asia Pacific markets. The 13 markets include Australia, China, Hong Kong, Indonesia, India, Japan, Korea, Malaysia, New Zealand, the Philippines, Singapore, Taiwan and Thailand. All respondents were pre-qualified as being involved in shaping their organisations’ digital strategy, and are working in firms with more than 250 employees.

[2] Microsoft Asia Pacific survey of 1,200 IT leaders across 12 markets to understand how they are evolving their IT infrastructure strategies to meet the needs of a digital business. Read more here: https://news.microsoft.com/apac/2016/11/24/microsoft-survey-it-leaders-in-asia-are-prioritizing-hybrid-cloud-to-transform-it/