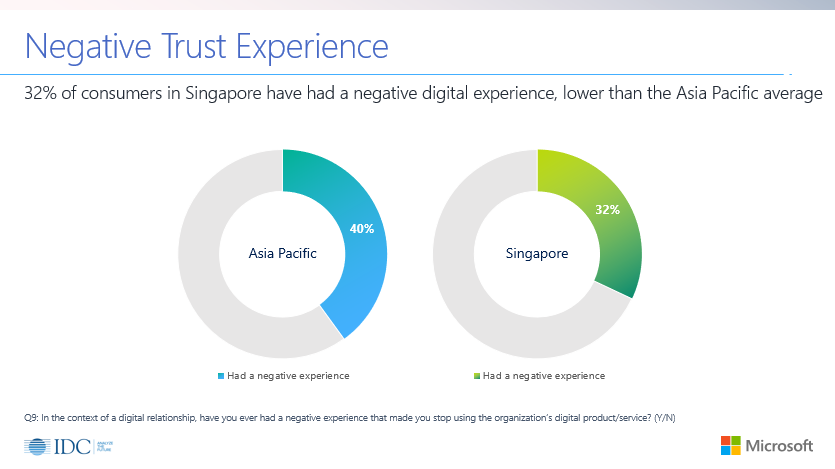

The study also revealed that 32% of consumers in Singapore have had their trust compromised when using digital services; and only 1 in 20 consumers (5%) prefer to transact with an organisation that offers a cheaper but less trusted digital platform

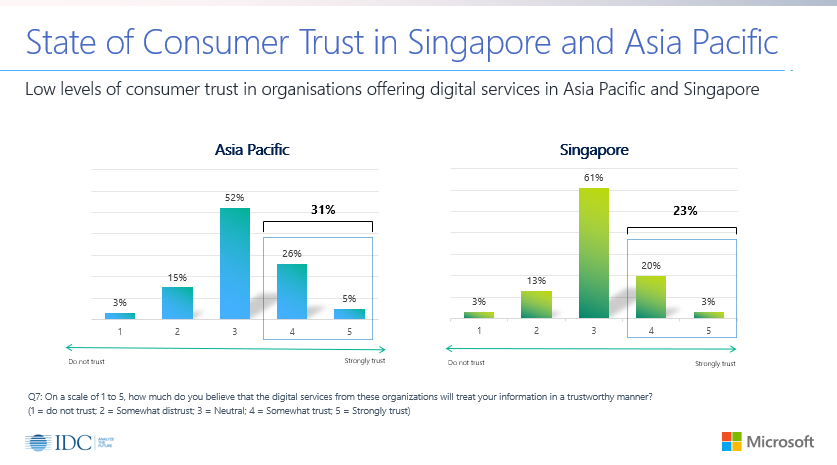

Singapore, 16 April 2019 – Highlighting a strong need to build greater trust in digital services, a study from Microsoft and IDC Asia/Pacific titled Understanding Consumer Trust in Digital Services in Asia Pacific[1] revealed that less than one in four (23%) of consumers in Singapore believed that their personal data will be treated in a trustworthy manner by organisations offering digital services. This figures places Singapore below the Asia Pacific average of 31%.

Today, almost all transactions and interactions have gone digital. From our daily correspondences with organisations and government agencies to the transactions made via banks and retailers, more and more of these interactions are being conducted digitally. At the same time, consumers are becoming more aware of the cybersecurity and personal data privacy risks, not just from cybercriminals at large but also from organisations that collect personal data.

By uncovering consumers’ expectations of trust, their negative experiences with digital services and their views of the organisations that should be responsible for building trust, the Microsoft – IDC Asia/Pacific study aims to provide tangible insights to organisations in Singapore to help bridge the trust gap, and empower them to earn and sustain the trust of consumers in the digital world.

“While we have observed an increasing reliance on digital services by Singapore consumers in the way they live, work and play, there is still a considerable trust gap that needs to be addressed,” said Richard Koh, Chief Technology Officer, Microsoft Singapore. “As both private and government organisations turn to digital to engage with consumers and citizens, trust is becoming an important business differentiator. Organisations need to take a more active approach to understand the key factors that drive consumer trust and focus on building trust in their digital services to gain a competitive advantage now and into the future.”

Security, privacy and reliability emerge as the most important elements for trust

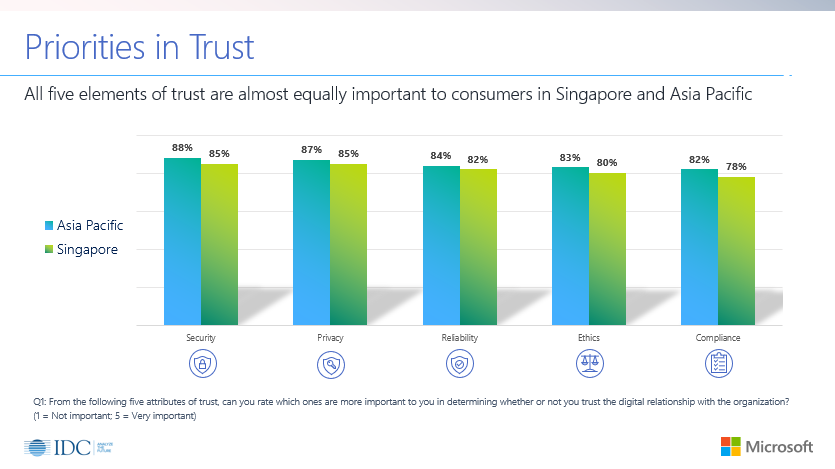

The study, which surveyed 6,372 consumers across 14 markets in Asia Pacific, including 461 consumers in Singapore, asked respondents to rate the importance of the five elements of trust defined by IDC and Microsoft – namely privacy, security, reliability, ethics, and compliance[2] – when using digital services.

The findings revealed that Singapore consumers ranked all five elements of trust as almost equally important to them. Specifically, security (85%), privacy (85%) and reliability (82%) emerged as the top three most important elements for trust. Consumers in Singapore also have the highest expectations of trust from organisations in the financial services sector, followed by the government and healthcare sectors.

Trust in digital services is fragile in Singapore

As organisations in Asia Pacific continue to transform their business models, offerings and customer engagement strategies, the range of digital services available to consumers will grow in number and variety.

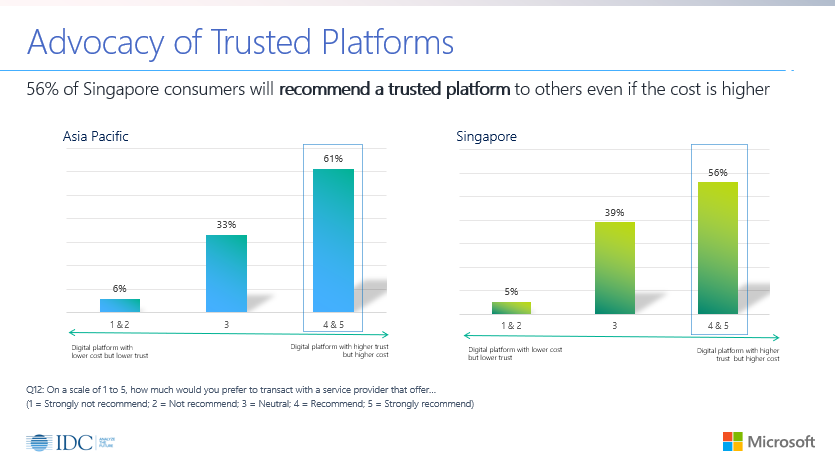

The study found that establishing a trusted platform needs to be a priority in organisations’ strategies for digital services as only 5% of consumers in Singapore prefer to transact with an organisation that offers a cheaper but less trusted digital platform. Additionally, more than half of the Singapore consumers (56%) highlighted that they would recommend a trusted digital service to others even if the cost is higher.

“Trust is critical for organisations to succeed in this digital world as consumers overwhelmingly prefer to transact with organisations with a trusted digital platform,” said Simon Piff, Vice President of Security Practice, IDC Asia/Pacific. “As competition between digital services becomes more intense and global in nature, advocacy through word of mouth can be a strong differentiator for the organisation and a shot in the arm for the brand.”

Despite this, the study uncovered that 32% of Singapore consumers have had their trust compromised when using digital services, lower than the Asia Pacific average of 40%. The top three trust elements that caused consumers in Singapore to stop using digital services are security (58%), reliability (57%) and privacy (51%).

More importantly, the study established that consumers will take action if they have a negative trust experience. Half of the Singapore respondents would either switch to another organisation, reduce the usage (43%) of the digital service or stop using (38%) the digital service altogether.

Impact of artificial intelligence on consumers’ future

Artificial intelligence (AI) is the defining technology of our generation that will become the centre of our digital world. When harnessed properly, AI can solve our biggest problems – from finding the cure to diseases to creating a more sustainable world.

Although the adoption of AI is still in its nascent stages, most consumers (92%) in Singapore are aware of AI and over 3 in 10 respondents (34%) expressed clear optimism about the future of AI. Singapore consumers are also generally optimistic about the impact of AI on their jobs – 71% believe that the impact will be positive.

Building trust in artificial intelligence and digital services

As technology continues to transform how we live, work and play, all organisations providing digital services and harnessing the capabilities of AI should be responsible for fulfilling the five elements of trust with their customers directly. However, the responsibility of building trust should not just be on the shoulders of these organisations providing digital services but also the broader industry, including government institutions and technology companies.

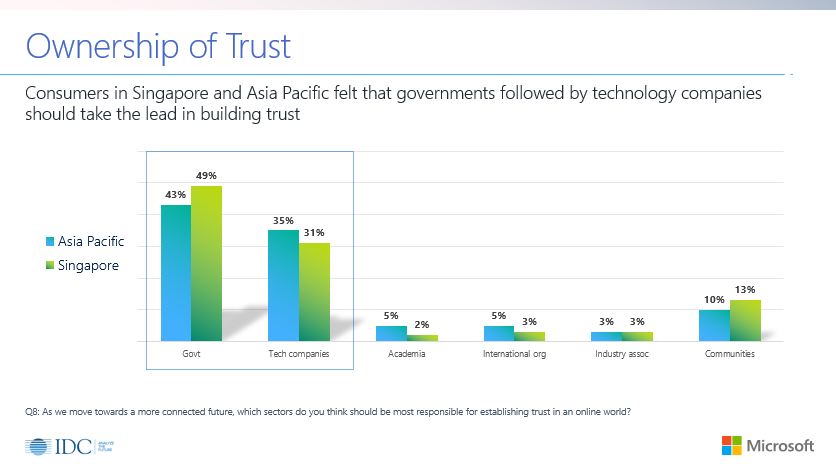

Findings showed that consumers in Singapore felt that the government (49%) should take the lead in building trust, followed by technology companies (31%). This indicates the need for a stronger partnership between the private and public sectors.

Interestingly, a significantly higher percentage of Singapore Baby Boomers (62%) felt that the government should take the lead in establishing trust in digital services, compared to Gen X (50%) and Gen Y (49%). Furthermore, Gen Z consumers in Singapore felt that technology companies (48%) should take the lead in building trust, more so than the government (34%).

When it comes to fostering trust in AI technologies, Singapore consumers noted that the government (51%) and technology companies (29%) should take the lead in ensuring AI is used in a trusted manner.

“To establish a trusted framework for the development and usage of AI and technology in general, we must first consider its impact on individuals, businesses and society. This would require a broader discussion that involves the government, technology companies, industry associations, international organisations, academia and communities at large. These dialogues would also need to be backed by appropriate actions, including forging closer partnerships and facilitating greater knowledge exchange, in order to enable us to collectively establish a well-balanced, holistic baseline for trust for the entire industry,” Koh concluded.

###

[1] About the Microsoft-IDC Study: Understanding Consumer Trust in Digital Services in Asia Pacific

- 6,372 consumers across Asia Pacific participated in this study, which was conducted in December 2018.

- An equal ratio of males and females were surveyed.

- Consumers were from four different age groups: Gen Z – 15 years old to 25 years old (20%); Gen Y – 26 years old to 40 years old (30%); Gen X – 41 years old to 55 years old (30%); and Baby Boomers – 56 years old to 75 years old (20%).

- All respondents come from a broad spectrum of occupations, from management, professions to students and home makers.

- 14 Asia Pacific markets were involved: Australia, China, Hong Kong, Indonesia, India, Japan, Korea, Malaysia, New Zealand, Philippines, Singapore, Taiwan, Thailand and Vietnam. 461 consumers from Singapore participated in the study.

- An important qualifier for the Study is that these consumers need to be digitally active in their daily lives, where they regularly perform online activities such as banking, shopping and have had social media engagements in last 90 days.

[2] Definition of the five trust elements provided to the study’s respondents:

- Privacy: the organisation providing digital services takes all steps to keep my personal information private and used only for the purposes which I approve;

- Security: the organisation providing digital services takes appropriate steps to ensure my personal information is always secure;

- Reliability: the organisation providing digital services maintains its product and services to work consistently and with minimal disruption;

- Ethics: the organisation providing digital services uses the data it collects from me in an ethical manner based on standards of honesty, fairness and inclusiveness;

- Compliance: the organisation providing digital services ensures that the products and services I use adhere to established industry and statutory regulations.