Shift achieves rapid business growth and delivers finance on demand in the cloud

Businesses rely on access to funds to operate and grow. The responsiveness of their finance provider is a huge factor in deciding where they source it from.

Leveraging the latest advances in technology to transform its systems and processes, Shift has carved out a new category in Australia’s fintech sector by making finance on demand possible for businesses.

“With traditional lending the process can be long and clunky. Then once the customer is signed up, there’s not much flexibility.

“The Shift difference is that our customers use the Shift platform to trade, pay and access funds when and how it suits them.,” says Eldar Averdi, Chief Technology Officer at Shift.

“We don’t have the slow, cumbersome processes that traditional lenders have, which can be restrictive to growing businesses. We’re very mindful when we’re working with customers that our role is to give them the financial certainty they need, so they can get on with running their business.

Originally established as GetCapital in 2014, the company rebranded as Shift in 2021 as part of its mission to provide a simpler, on demand way for Australian businesses to access the financial products that suit them, now and down the track.

Businesses that use Shift register once to access a range of credit and payment solutions, including overdrafts, equipment finance, growth capital and trade accounts to pay suppliers and manage cashflow, as well as working with merchants and their customers to simplify and facilitate trade finance. The fintech player also offers a powerful platform for brokers who manage business clients end to end or refer them to Shift for servicing.

Shift differentiates itself from traditional lenders and other credit providers by using several in-house proprietary platforms and streaming data to deliver decisions in real time.

“We offer a simple and easy three step onboarding process”, says Averdi. “It takes only a few minutes for the business customers to get to a real-time decision to pay their invoices or access funds from the newly created facility.

The convenience and time play a major role for our customers, being a small coffee shop business to the large enterprise.

The company embarked on a major digital transformation three years ago to achieve its goal of delivering finance on demand.

In the first six months, we had to build the entire technology team from inside, reduce vendor dependency, build internal intellectual property, modernise our technology stack and embrace an agile execution culture. Fast-forward a few years, and we have seen great transformation results with the release of our broker and business customer platforms.”

“To get to finance on demand, we needed to make sure our platforms were fast and reliable. We needed to apply new ways to analyse data, and incorporate technology needed to allow us to make decisions within minutes, if not seconds.”

Central to Shift’s strategy was the modernisation and simplification of its data processing infrastructure which, at the time, was a combination of on-premises and cloud services. The company wanted to move to a cloud-only approach where it could build and deploy scalable platforms and microservices.

Allured by Azure

Shift’s technology team researched several cloud providers to see how they could support its business growth, and were impressed with Microsoft Azure’s capabilities.

Paul Novak, Head of Engineering at Shift, commented that he had experienced minimal interaction with Azure prior to the company’s assessment of cloud providers.

“We’d been primarily using other cloud providers but gravitated towards Azure,” says Novak. “When we looked into Microsoft’s platform and the maturity of what it offered, we were very surprised.

“During our research, we did POCs [proofs of concept] in a range of platforms to see if we could get our Kubernetes cluster established and set up in the cloud in the simplest and nicest way. We found the entry point for Azure was much lower than others. It was a lot easier to understand, it offered plenty of flexibility and it took half the time for us to set up.

“Azure gives us a strong capability for managing the software development lifecycle using the GitOps approach in combining a Kubernetes cluster and their continuous integration pipeline, ultimately bringing down the complexity of environment configuration and reducing deployment time from days to minutes.”

Shift is now 100 per cent in cloud, with four clusters, each with their set of microservices and portals that can be automatically scaled through Azure. It even gave some of its old physical servers to charity.

Novak notes that Microsoft provided great support during the set-up process.

“We have been assigned a dedicated Microsoft success team, which we leveraged through multiple video conferences, talking to cloud architects from Azure during the onboarding process,” he says.

Microsoft has been really supportive from day one, which gave us the confidence to efficiently implement Shift’s new systems in the cloud.

According to Chris Olver, Head of Infrastructure at Shift, another reason why Shift chose Azure was because it offered a much stronger data framework compared to other cloud platforms, which has enabled the company to solve multiple complex business problems.

“We can create a proper data flow to support its big data, using Azure Data Lake, Azure Data Warehouse and Azure SQL, as well as non-SQL services like Azure Storage and Cosmos DB, we found it very mature and simple for us to integrate,” Olver explains.

“Our POC showed that we could establish an Azure Data Lake and Azure Data Warehouse within one day using Azure Data Factory. We realized we could achieve it without needing documentation and we’re 95 per cent there. This has allowed us to develop and deploy rapidly.”

“We have built and trained dozens of AI models using Azure Data Lake and Databricks, hosting them across Kubernetes and Azure Functions to achieve real-time decisions at scale,” Olver says.

Averdi says Azure’s rich data and machine learning capabilities played a part in Shift’s journey to offering finance-on-demand.

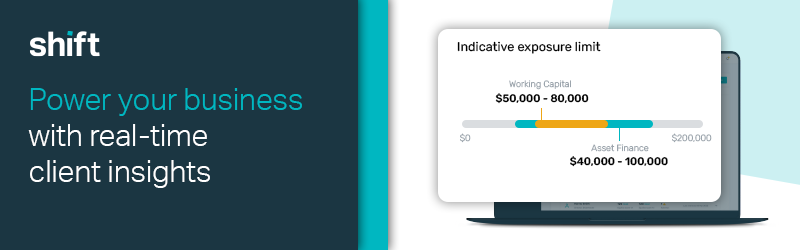

“Azure’s machine learning capabilities are embedded into our internally built decisions engine that we build a profile rating for each customer. This rating doesn’t just use banking data – we’re using ASIC data, credit score data and internal data. It all fits into multiple models, with our platform classifying data and producing a total score. It takes seconds to achieve decisions, so customers can focus on their business growth with confidence and brokers can have more insightful conversations with their clients.”

Foundations for future growth

Shift has enjoyed phenomenal growth by evolving its product offering and technology capabilities. The company has doubled its revenue almost every year, and Averdi expects this positive trend to continue in 2022.

“We’ve just completed our rebrand and released the latest iteration of our Shift Connect platform for brokers. The current focus for us is on scaling the business using our solid digital foundations while constantly evolving our broker, merchant and customer platforms,” he says.

“With the number of daily transactions being processed through our back-end increasing, we need to make sure our platform ecosystem can support this. As a result, we’re in a state of constant transformation.”

Our focus is two-fold: while evolving our product range to suit the changing needs of Australian businesses, we also constantly develop ways to unlock new data and insights capabilities for our brokers and customers to help them make more informed decisions.

“It’s a massive plan, but we’ve reached a milestone where we have the right foundations, and now it’s hyperscale time.”