Thriday rescues tired Aussie business owners from financial admin with all-in-one platform

Small businesses are the engine room and backbone of Australia’s economy. They make up 98 per cent of all businesses, employ 42 per cent of the private sector workforce and contribute to a third of the nation’s gross domestic product, according to the Australian Small Business and Family Ombudsman.

However, succeeding as a small business owner in Australia doesn’t come without its challenges. Many struggle to achieve a healthy work–life balance, putting in long hours to keep everything running.

“One of the biggest contributors to this lack of work–life balance is the unexpected time that business owners spend on financial admin tasks that take up their day, or keep them up at night,” says Michael Nuciforo, CEO of Australian startup Thriday.

“Even though good financial management is cited by business owners as the number one factor in running a successful business, most business owners struggle to carve out the time required to do it properly.”

It’s one of the key reasons why Nuciforo co-founded Thriday – formerly known as Thrive – with Ben Winford in 2019.

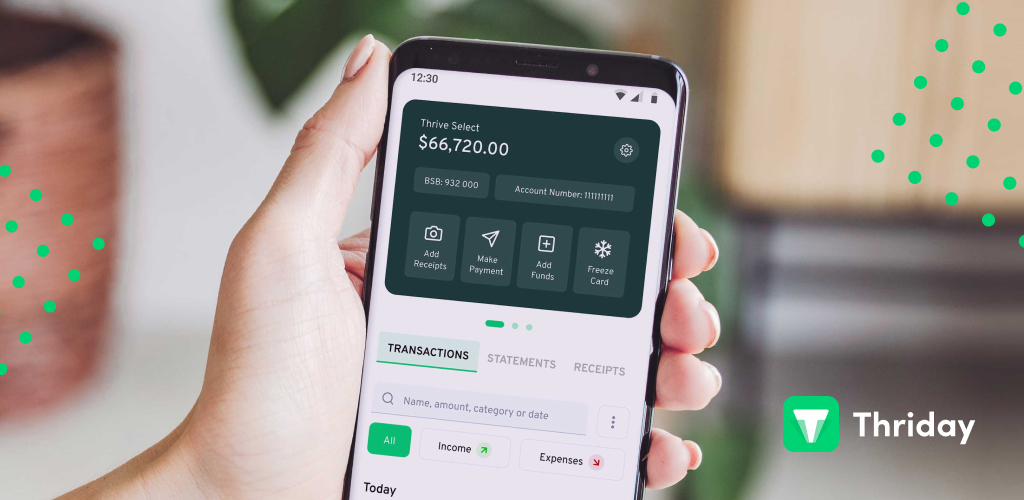

Thriday simplifies the lives of small business owners by combining the tools they need to manage and automate financial administration. Harnessing the power of AI and machine learning, the platform enables small business owners to open business banking transaction accounts in minutes; quickly create quotes and invoices; access cash flow and tax forecasts in real time; scan, send and save receipts from anywhere; and lodge business activity statements.

“We started with the concept of where we saw most of the activity in a business occurring from a financial admin point of view – the transaction account – and then worked our way up to things like accounting and tax,” says Winford.

“The quality and immediateness of data is our key differentiator. The level of automation we can provide and the amount of financial admin we can eliminate for small business owners is amplified by the quality of the data and the speed at which we can use it.”

Thriday’s Chief Technology Officer, Warren More, says the startup was also born out of frustration with the poor quality of financial management solutions offered to small businesses.

“The current financial management system is optimised to generate as much value as possible for everyone except the small business owner,” he explains.

This system forces small business owners to spend over six hours per week managing their financial admin. It consists of multiple service providers, multiple products and multiple regulations. The cost of that privilege is over A$4,000 per year on average.

More says Thriday is designed to reduce the time small businesses spend managing financial admin to just 30 minutes per week, while also saving them a significant amount of money.

“It’s like having a bookkeeper, accountant and transaction account in your pocket,” he explains. “Thriday is more than just a financial management platform – it’s a productivity platform designed to simplify the lives of small business owners.

“Our real differentiator that allows us to automate so much more and save so much more time is the built-in transaction account feature, where the real-time income and expense data powers the automation behind the scenes.”

Serverless cloud architecture ensures data security and compliance

More and his team started designing the platform in August 2020 and it went live for sole traders in August 2022, after passing a range of security tests and gaining ISO/IEC 27001 certification – a globally recognised standard for information security management systems. The platform was officially launched to the broader public in October 2022.

Thriday uses serverless, event-driven architecture in Microsoft’s Azure data centre regions across Australia to power its web platform and mobile app, keep data secure and meet compliance requirements. It also uses Azure DevOps and Visual Studio App Center for work item management and software development, as well as Microsoft 365 for office productivity and endpoint security.

More says that using these Microsoft services has resulted in a very agile and effective development team, satisfied end users and peace of mind around securing valuable data.

“We were fortunate to get into the Microsoft for Startups program in 2020 and leveraged the tech consult sessions with Microsoft architects to review our platform and offer advice,” he adds. “We also work with Microsoft Specialised Partner Arinco to assist us with identity management, DevOps and performance troubleshooting.”

Long-term growth philosophy key to Thriday’s thriving platform

“Thriday provides back-end automation today and will deliver intelligent growth for the SMB sector tomorrow. Its Microsoft AI powered platform not only takes the headache out of financial admin, but enables transformation and agility for small business owners. Our trusted cloud and technology are key ingredients for startups to scale and we look forward to seeing Thriday drive economic progress in Australia, and eventually across the world.” Ahmed Mazhari, President, Microsoft Asia

Thriday has grown rapidly to have 30 employees working worldwide, including in Australia, India, Scotland and South Africa. Thriday launched in October 2022 to a waitlist of more than 11,000 small businesses.

“We’re very conscious of scaling too fast and would prefer to have happy customers that we retain,” says Winford. “Our philosophy is that we’re in it for the long haul rather than quickly growing to 200,000 users.”

One of those happy customers is Lauren Deuble, whose company All Wrapped Up VA provides administration support for small- and medium-sized businesses.

“I find Thriday incredibly simple to use. It makes sense to me,” she says.

It saves me so much time, which means more time with my family.

Deuble adds that the platform has enabled her to “actually enjoy accounting, which has never happened before”.

For Jo Washington-King, Lending Executive at Project 1 Finance, Thriday has delivered significant cost savings. “By putting banking, accounting and bookkeeping together, it’s helped me save a lot of money, which has been great,” she says.

And Beckerleg Carpentry Co.’s Kiki Beckerleg says Thriday’s focus on delivering a high level of customer experience is a key reason why she chose to use the platform, saying: “Their team is really dedicated to making your life easier by automating your financial admin.”

Thriday has also been very successful in raising funds to accelerate its growth. The startup broke Australian crowdfunding records in February 2021 by raising A$3 million in just three days. More recently, it raised A$6 million in a pre-Series A funding round led by NAB Ventures.

And in November 2022, Thriday signed an exclusive banking-as-a-service partnership with Regional Australia Bank (RAB). The agreement will see RAB issue Visa debit cards to customers who open a transaction account on the platform.

The startup plans to continue improving the performance and stability of its platform using services such as Azure Machine Learning, Azure Application Insights, Microsoft Defender and Microsoft Sentinel. Thriday also plans to expand its data geo-replication strategy across Azure regions and leverage Microsoft Dynamics 365 to improve the customer experience.

Ultimately, the team’s mission is to eliminate financial admin for small business owners. “Thriday’s technology should automate financial admin tasks to the point that they feel as good as eliminated, so owners can maintain control of their time and focus on the things that matter,” Nuciforo wrote in a recent blog post.