Across Canada, AI is becoming a foundational part of how organizations operate, innovate and compete – guided by a distinctly Canadian approach. What’s emerging is not just a story of acceleration, but of thoughtful progress. Organizations are moving beyond experimentation and into real transformation, embracing AI as a catalyst for new ways of working, serving customers responsibly, and strengthening Canada’s ability to compete on the global stage – with trust, people, and long-term impact at the centre.

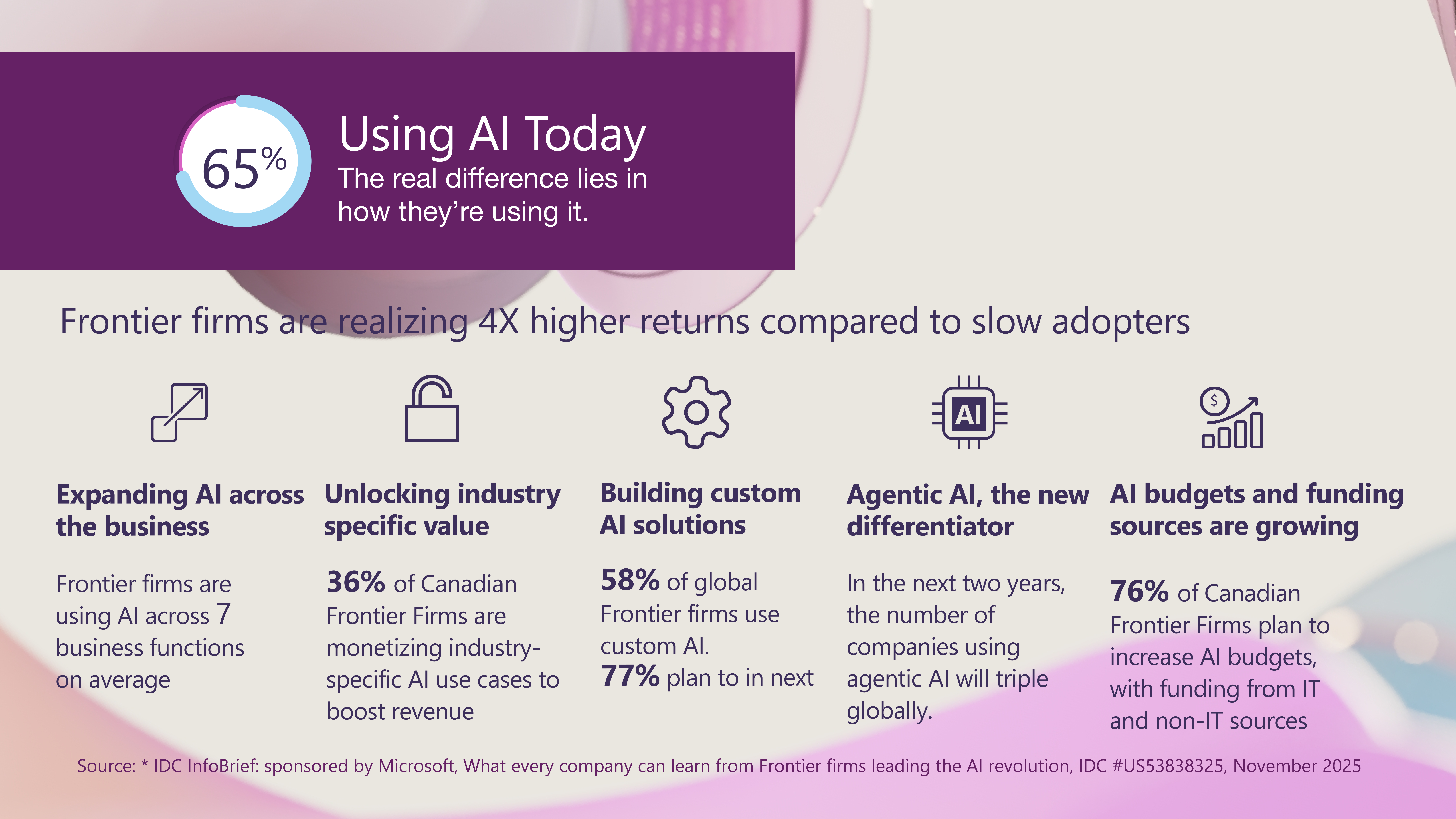

To better understand this transformation, Microsoft commissioned a global study with the International Data Corporation (IDC) of more than 4,000 business leaders responsible for AI decisions. According to the study, 65% of Canadian companies surveyed are using AI today, but the real difference is how they’re using it. A new class of companies – Frontier Firms – are leading in AI transformation and report they are achieving returns that are three times higher than slow adopters.

While Frontier Firms still represent a small percentage (14% in Canada vs. 22% globally), their progress shows what the next era of competitiveness could look like. They’re achieving stronger outcomes, building operational momentum, and setting a new pace for innovation.

What sets Frontier Firms apart

Based on the IDC study, Microsoft has identified five key lessons learned that characterize Frontier Firms and outline how organizations use AI to drive meaningful business transformation. Read on to also learn about five examples of Canadian organizations that are leading with AI.

1. They Scale AI Across the Entire Business

On average, Frontier Firms use AI across seven business functions, with especially strong adoption in customer service, marketing, IT, product development and cybersecurity.

This broad integration is translating into outsized results. Globally, Frontier Firms report better outcomes at a rate that is 4X greater than slow adopters. In Canada, Frontier Firms stand out globally, reporting strong outcomes in risk management performance (97% vs 88% globally) employee productivity (84%) and product/service innovation (82%).

2. They Apply AI to Industry-Specific Problems

While many organizations start their AI journey with a focus on productivity, Frontier Firms use AI to solve deeper, industry-driven challenges: supply chain optimization, fraud detection, precision forecasting, personalized banking, regulatory compliance, manufacturing quality, and more.

According to the study, 36% of Canadian companies are currently monetizing industry-specific AI use cases to boost revenue – but that number could jump significantly with over 55% saying they plan to within 24 months, signaling a major shift from experimentation to transformation.

3. They Build Custom AI To Capture Their Competitive Advantage

The data revealed that globally 58% of Frontier Firms are using custom AI solutions. Custom AI solutions allow businesses to embed proprietary knowledge, tone, and compliance into every interaction. They can be fine-tuned on proprietary data or industry-specific knowledge, enabling higher accuracy in predictions or content generation and better alignment with business goals and compliance needs.

Within the next 24 months, 77% of Frontier Firms globally plan to use custom AI solutions. This reflects a growing trend that AI leaders are layering in deeper strategic integrations of AI across their business.

4. They’re Embracing AI Agents

Agentic AI — systems that can reason, plan and act with human guidance — is quickly becoming the next defining capability of Frontier organizations. In the next two years, IDC expects agentic AI adoption to triple globally, with applications emerging across finance, sales and customer service. Leaders today face a familiar challenge — teams are operating at full capacity, yet the demand for innovation and impact continues to grow. That’s where AI agents come in.

5. Their AI Budgets and Teams Are Growing

AI investment isn’t slowing down. Seventy-six percent (versus 71% globally) of Canadian respondents plan to increase their AI budgets, with funding coming from IT and non-IT sources. And the current macroeconomic climate is not stopping Canadian organizations from investing in generative and agentic AI – 78% say they’ve made investments, with 34% adding a net new investment, and 44% repurposing a portion of IT or non-IT budgets to allocate towards AI. This spread of investment sources shows that AI isn’t being treated as a tech initiative, it’s becoming a business transformation strategy supported across the organization.

Becoming Frontier – Canadian Organizations Leading with AI

Across Canada, organizations are moving in the direction of Frontier, with strong AI adoption and innovation driving the economy and country forward. Read on to see how leading Canadian businesses across sectors are modernizing, scaling and reshaping their operations with AI.

BMO is leveraging AI to transform banking and deliver client-first innovation. As one of Canada’s leading financial institutions, BMO is embedding AI across its operations to simplify experiences, accelerate decision-making, and unlock new value for customers. Through its collaboration with Microsoft and Azure OpenAI Service, BMO has introduced AI-powered solutions like digital assistants that streamline complex processes, enabling advisors to focus on personalized client engagement. These initiatives reflect BMO’s commitment to responsible, secure AI adoption and position the bank at the forefront of digital transformation. By pairing human expertise with AI-first differentiation, BMO is driving efficiency, enhancing trust, and setting new benchmarks for innovation in financial services. BMO’s approach focuses on using AI to amplify human ambition and deliver meaningful impact for customers and communities.

First West Credit Union, one of Canada’s largest credit unions, is transforming member service through the first enterprise-wide deployment of Microsoft 365 Copilot in the country’s financial services industry. With more than 1,300 employees now using AI-powered assistance, First West is streamlining daily tasks, accelerating complex workflows like mortgage renewals, and giving advisors instant access to member insights. The result is a more human-centered banking model where teams can focus less on admin and more on meaningful, personalized member relationships.

Scotiabank is pioneering AI-agent automation in partnership with EY and Microsoft. To modernize its traditionally manual Client Insight Report – an analysis of complex, inconsistent payment data – the bank rapidly built a system of specialized AI agents using Microsoft Copilot. Developed in under three months by a small team, the solution operates like a digital assembly line, with each agent handling tasks from data cleaning to report generation. The result is faster, more consistent insights delivered at scale, with human expertise amplified by AI to better serve clients.

TD, one of Canada’s largest banks, has deployed Microsoft 365 Copilot to over 25,000 colleagues across Canada and the US spanning multiple lines of business in 2025. Currently they have an impressive active user engagement rate of 80%, and expect to scale deployment further in 2026, continuing to make the way their colleagues work simpler and faster.

WSP, a Montreal-based global leader in engineering and professional services, is empowering tens of thousands of engineers and scientists with Microsoft 365 Copilot—enabling them to spend more time on innovation and impact. By integrating AI into the flow of work, WSP is streamlining routine processes and freeing up valuable time for collaboration, training, and upskilling. This transformation allows WSP professionals to focus on solving complex challenges and delivering greater value to clients and communities worldwide.

Explore how Microsoft’s AI solutions can transform your organization. Leverage our resources to innovate with AI and start your journey to becoming a Frontier Firm.