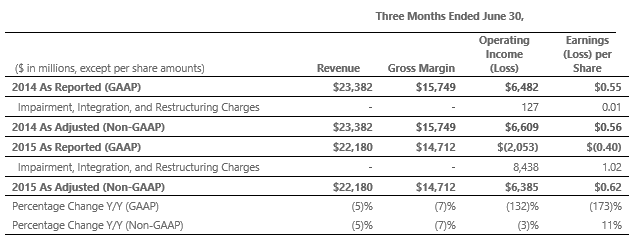

REDMOND, Wash. — July 21, 2015 — Microsoft Corp. today announced that revenues for the quarter ended June 30, 2015 were $22.2 billion. Gross margin, operating loss, and loss per share for the quarter were $14.7 billion, $(2.1) billion, and $(0.40) per share, respectively.

These results include the impact of a $7.5 billion non-cash impairment charge related to assets associated with the acquisition of the Nokia Devices and Services (NDS) business, in addition to a restructuring charge of $780 million. There was also a charge of $160 million related to the previously announced integration and restructuring plan. Combined, these items totaled $8.4 billion or a $1.02 per share negative impact. Excluding this impact, operating income and EPS would have been $6.4 billion and $0.62, respectively.

During the quarter, Microsoft returned $6.7 billion to shareholders in the form of share repurchases and dividends.

The following table reconciles these financial results reported in accordance with generally accepted accounting principles (“GAAP”) to Non-GAAP financial results. Microsoft has provided this Non-GAAP financial information to aid investors in better understanding the company’s performance. All growth comparisons relate to the corresponding period in the last fiscal year.

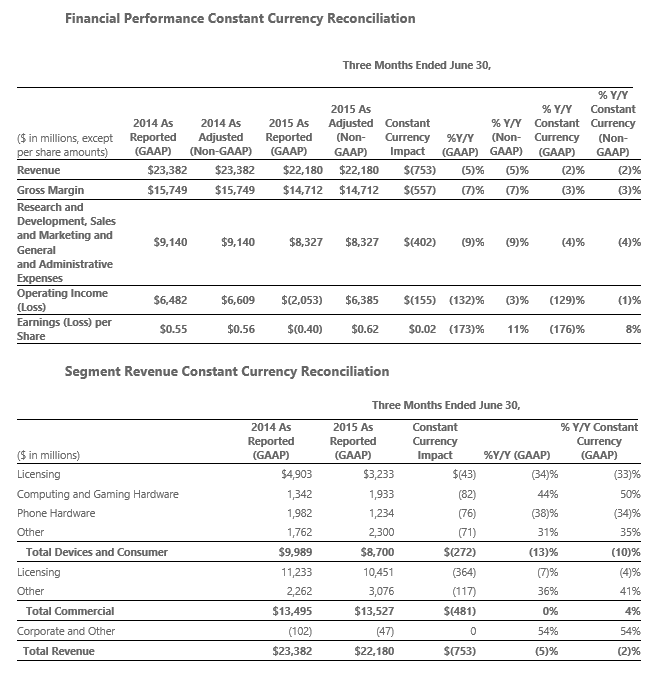

The strengthening of the U.S. dollar compared to foreign currencies had a significant impact on results in the quarter. Excluding the effect of foreign exchange rate changes on the GAAP amounts, on a constant currency basis, revenue and gross margin would have declined 2% and 3%, and operating income and EPS would have declined 129% and 176%, respectively. Excluding the effect of foreign exchange rate changes on the Non-GAAP amounts, on a constant currency basis, revenue and gross margin would have declined 2% and 3%, respectively, and operating income and EPS would have declined 1% and increased 8%, respectively.

“Our approach to investing in areas where we have differentiation and opportunity is paying off with Surface, Xbox, Bing, Office 365, Azure and Dynamics CRM Online all growing by at least double-digits,” said Satya Nadella, chief executive officer at Microsoft. “And the upcoming release of Windows 10 will create new opportunities for Microsoft and our ecosystem.”The strengthening of the U.S. dollar compared to foreign currencies had a significant impact on results in the quarter. Excluding the effect of foreign exchange rate changes on the GAAP amounts, on a constant currency basis, revenue and gross margin would have declined 2% and 3%, and operating income and EPS would have declined 129% and 176%, respectively. Excluding the effect of foreign exchange rate changes on the Non-GAAP amounts, on a constant currency basis, revenue and gross margin would have declined 2% and 3%, respectively, and operating income and EPS would have declined 1% and increased 8%, respectively.

“We finished the fiscal year with solid progress against our strategic priorities, through strong execution and financial discipline, which is reflected in our results for the quarter and the year,” said Amy Hood, executive vice president and chief financial officer at Microsoft.

Devices and Consumer revenue declined 13% (down 10% in constant currency) to $8.7 billion, with the following business highlights:

- Windows OEM revenue decreased 22% as revenue was impacted by PC market declines following the XP end-of-support refresh cycle

- Surface revenue grew 117% to $888 million, driven by Surface Pro 3 and launch of the Surface 3

- Total Xbox revenue grew 27% based on strong growth in consoles, Xbox Live transactions and first party games

- Search advertising revenue grew 21% with Bing U.S. market share at 20.3%, up 110 basis points over the prior year

- Office 365 Consumer subscribers increased to 15.2 million, with nearly 3 million subscribers added in the quarter

Commercial revenue increased slightly (up 4% in constant currency) to $13.5 billion, with the following business highlights:

- Commercial cloud revenue grew 88% (up 96% in constant currency) driven by Office 365, Azure and Dynamics CRM Online and is now on an annualized revenue run rate of over $8 billion

- Server products and services revenue grew 4% (up 9% in constant currency), with stable annuity performance offsetting declines in transactional revenue

- Dynamics revenue grew 6% (up 15% in constant currency), with the Dynamics CRM Online install base growing almost 2.5x

- Office Commercial products and services revenue declined 4% (up 1% in constant currency), with continued transition to Office 365 and lower transactional revenue due to declining business PCs following the XP end-of-support refresh cycle

- Windows volume licensing revenue declined 8% (down 4% in constant currency), driven primarily by transactional revenue declining following the XP end-of-support refresh cycle with annuity growth on a constant currency basis

“In our commercial business we continue to transform the product mix to annuity cloud solutions and now have 75,000 partners transacting in our cloud,” said Kevin Turner, chief operating officer at Microsoft. “We are also expanding the opportunity for more partners to sell Surface, and in the coming months will go from over 150 to more than 4,500 resellers globally.”

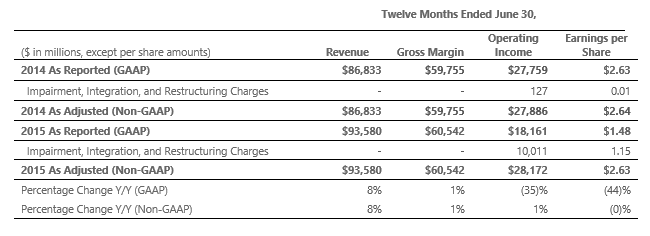

For Microsoft’s fiscal year 2015, the company’s revenue, gross margin, operating income, and diluted EPS were $93.6 billion, $60.5 billion, $18.2 billion, and $1.48 per share, respectively. Excluding the impact of impairment, integration and restructuring charges, full year operating income and EPS would have been $28.2 billion and $2.63, respectively.

The following table reconciles these financial results reported in accordance with GAAP to Non-GAAP financial results. This Non-GAAP financial information has been provided to aid investors in better understanding the company’s performance.

Business Outlook

Microsoft will provide forward-looking guidance in connection with this quarterly earnings announcement on its earnings conference call and webcast.

Webcast Details

Satya Nadella, chief executive officer, Amy Hood, executive vice president and chief financial officer, Frank Brod, chief accounting officer, John Seethoff, deputy general counsel, and Chris Suh, general manager of Investor Relations, will host a conference call and webcast at 2:30 p.m. PDT (5:30 p.m. EDT) today to discuss details of the company’s performance for the quarter and certain forward-looking information. The session may be accessed at http://www.microsoft.com/investor. The webcast will be available for replay through the close of business on July 21, 2016.

Adjusted Financial Results and Non-GAAP Measures

During the fourth quarter of fiscal year 2015, GAAP revenue, gross margin, operating loss, and loss per share included impairment, integration, and restructuring charges. For the fourth quarter of fiscal year 2014, the financial results included the charges related to the integration expenses associated with the acquisition of NDS . These items are defined below. In addition to these financial results reported in accordance with GAAP, Microsoft has provided certain Non-GAAP financial information to aid investors in better understanding the company’s performance. Presenting these measures without the impact of these items gives additional insight into operational performance and helps clarify trends affecting the company’s business. For comparability of reporting, management considers this information in conjunction with GAAP amounts in evaluating business performance. These Non-GAAP financial measures should not be considered as a substitute for, or superior to, the measures of financial performance prepared in accordance with GAAP.

Non-GAAP Definitions

During the fourth quarter of fiscal year 2015, impairment, integration, and restructuring charges were $8.4 billion. Microsoft recorded $7.5 billion of goodwill and asset impairment charges related to Phone Hardware, and $780 million of restructuring expenses, primarily costs associated with the restructuring announced on July 8, 2015. There was also a charge of $160 million related to the previously announced integration and restructuring plan.

For fiscal year 2015, impairment, integration, and restructuring charges were $10.0 billion, compared with $127 million in the prior year. This includes $7.5 billion of goodwill and asset impairment charges related to Phone Hardware, and $780 million of restructuring expenses, primarily costs associated with the restructuring announced on July 8, 2015. There was also a charge of approximately $1.7 billion related to the previously announced integration and restructuring plan.

Prior year expenses of $127 million in the fourth quarter of fiscal year 2014 were associated with the acquisition and integration of NDS. These expenses consisted of transaction fees and direct acquisition costs, including legal, finance, consulting and other professional fees. These costs also included employee compensation and termination costs associated with certain reorganization activities.

Constant Currency

Microsoft presents constant currency information to provide a framework for assessing how our underlying businesses performed excluding the effect of foreign currency rate fluctuations. To present this information, current and comparative prior period results for entities reporting in currencies other than United States dollars are converted into United States dollars using the average exchange rates from the comparative period rather than the actual exchange rates in effect during the respective periods. The non-GAAP financial measures presented below should not be considered as a substitute for, or superior to, the measures of financial performance prepared in accordance with GAAP. All growth comparisons relate to the corresponding period in the last fiscal year.

About Microsoft

Microsoft (Nasdaq “MSFT” @microsoft) is the leading platform and productivity company for the mobile-first, cloud-first world and its mission is to empower every person and every organization on the planet to achieve more.

Forward-Looking Statements

Statements in this release that are “forward-looking statements” are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors such as:

- intense competition in all of Microsoft’s markets;

- increasing focus on services presents execution and competitive risks;

- significant investments in new products and services that may not be profitable;

- acquisitions, joint ventures, and strategic alliances may have an adverse effect on our business;

- impairment of goodwill or amortizable intangible assets causing a significant charge to earnings;

- Microsoft’s continued ability to protect and earn revenues from its intellectual property rights;

- claims that Microsoft has infringed the intellectual property rights of others;

- the possibility of unauthorized disclosure of significant portions of Microsoft’s source code;

- cyber-attacks and security vulnerabilities in Microsoft products and services that could reduce revenue or lead to liability;

- disclosure of personal data that could cause liability and harm to Microsoft’s reputation;

- outages, data losses, and disruptions of our online services if we fail to maintain an adequate operations infrastructure;

- government litigation and regulation that may limit how Microsoft designs and markets its products;

- potential liability under trade protection and anti-corruption laws resulting from our international operations;

- Microsoft’s ability to attract and retain talented employees;

- adverse results in legal disputes;

- unanticipated tax liabilities;

- Microsoft’s hardware and software products may experience quality or supply problems;

- exposure to increased economic and operational uncertainties from operating a global business;

- catastrophic events or geo-political conditions may disrupt our business; and

- adverse economic or market conditions may harm our business.

For more information about risks and uncertainties associated with Microsoft’s business, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of Microsoft’s SEC filings, including, but not limited to, its annual report on Form 10-K and quarterly reports on Form 10-Q, copies of which may be obtained by contacting Microsoft’s Investor Relations department at (800) 285-7772 or at Microsoft’s Investor Relations website at http://www.microsoft.com/investor.

All information in this release is as of July 21, 2015. The company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the company’s expectations.

Note to editors: For more information, news and perspectives from Microsoft, please visit the Microsoft News Center at http://www.microsoft.com/news/. Web links, telephone numbers, and titles were correct at time of publication, but may since have changed. Shareholder and financial information, as well as today’s 2:30 p.m. PDT conference call with investors and analysts, is available at http://www.microsoft.com/investor.