Microsoft urges financial services firms to tackle data blindspots to reduce risk of costly failed CX projects

Study reveals opportunity to boost transformation impact

SYDNEY – 19 February, 2019 – New research has uncovered a significant transformation opportunity for financial services firms, with the potential to reduce the risk of costly failed CX projects and amplify the impact of data for customers and employees.

A study of 505 medium to large organisations conducted by business-to-business research agency, Colmar Brunton, and commissioned by Microsoft Australia, reveals that while most Australian enterprises (69 per cent) say they have an integrated digital transformation strategy, dig a little deeper and it turns out only 28 per cent have a company-wide strategy for sharing data.

Without access to a comprehensive array of data, financial services firms will be limited in their ability to intelligently use data to engage customers, empower people, optimise and automate processes, and transform products and services.

When asked about the importance of data in terms of automating business processes, 76 per cent of finance sector respondents said it was “somewhat to extremely” important; 82 per cent said the same about access to data to gain a 360-degree view of the customer; and 79 per cent said it was somewhat to extremely important for generating a real time insight into the pipeline of opportunities.

However, the research reveals that almost a third (30 per cent) of survey respondents say that there is little to no data sharing across the organisation.

The enterprise blindspots this creates is causing many transformation efforts to fail to reach their full potential.

The research reveals that financial services organisations in Australia have had more failed customer experience projects (compared to government and retail) as part of their digital transformation efforts – but they are the most optimistic about their progress.

More than four out of five (81 per cent) of financial organisations have had failed customer experience projects. Forty per cent of them say that 20-40 per cent of such projects fail.

There can be big dollars involved. Almost a third (32 per cent) of survey respondents said failed CX projects had cost $100,000-$500,000. Seven per cent had experienced project failures costing more than $500,000.

Tackle digital blindspots to accelerate transformation

Financial services firms currently rate themselves negatively on how they are using data to empower their people and transform process and product.

Michael O’Keefe, Business Applications Director at Microsoft says; “To transform, is to reimagine the organisation in every way possible. It requires an integrated digital strategy with comprehensive access to company-wide data at its heart. This encourages informed insights and better decision-making, which in turn, delivers dramatically enhanced outcomes. Think of it as democratising your corporate data.

“It’s really important that financial services firms identify and tackle their digital blindspots – and introduce policies, processes and technology that lets data help draft the organisational transformation blueprint.

“Finance firms have acknowledged that they are not yet delivering on their efforts in transforming products, optimising process and engaging people. Delivering on all components is critical for successful transformation.”

Crafting corporate-wide data sharing policies and implementing technology that allows all of an enterprise’s data to be accessed when and where it is required is critical. It is the best way to optimise decision making and take informed action across an organisation.

Customer engagement leads the way

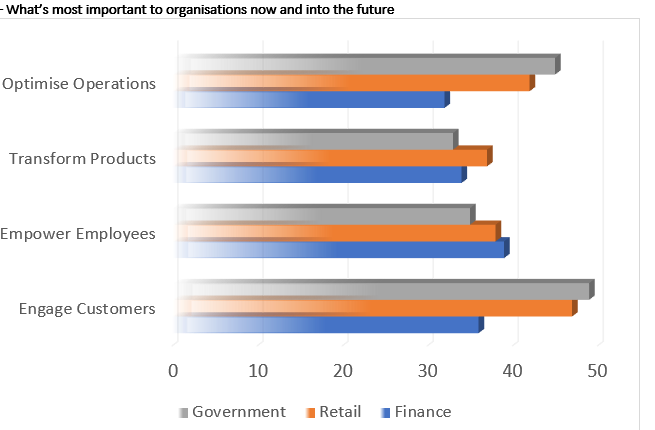

According to the survey, which focussed on the finance, retail and government sectors, organisations seek to address four key areas with their transformation efforts:

- Customer engagement

- Employee empowerment

- Operational optimisation

- Product/service transformation

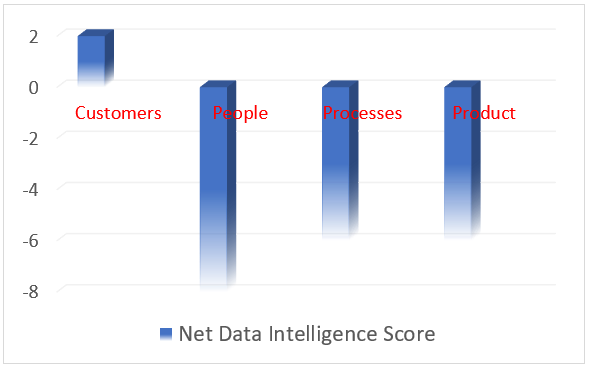

Survey respondents were asked to rate their maturity in intelligently using data across those four goals on a scale of zero to ten, producing a ‘Net Data Intelligence Score’ based on methodology similar to that used to calculate net promoter scores. Only ‘customer engagement’ entered positive territory at +2. The finance sector scored best in that category – but noted it still faced significant challenges in terms of gaining a clear 360-degree view of the customer and to engage with them across different channels.

Respondents across all three sectors reported that the biggest challenges they faced included being able to customise offers and bundle products and services with personal pricing; modify go-to-market strategies in real time; gain a 360-degree view of the customer; and validate and test new ideas. All of which require access to the right data at the right time.

The impact of that relative lack of maturity in using data, other than just for customers is clear when it comes to tracking the success of transformation efforts in each area. Put simply – if you don’t have access to or use data appropriately, you can’t expect transformation success.

Breaking down transformation barriers

Respondents noted that the two major barriers to successful transformation were a lack of senior management support (64 per cent) and a lack of company strategy from the board down (61 per cent). Interestingly customer and employee resistance to change also ranked highly at 55 and 56 per cent respectively.

This suggests that there needs to be a much clearer narrative from the top about the importance of transformation to the organisation and the benefits it will deliver.

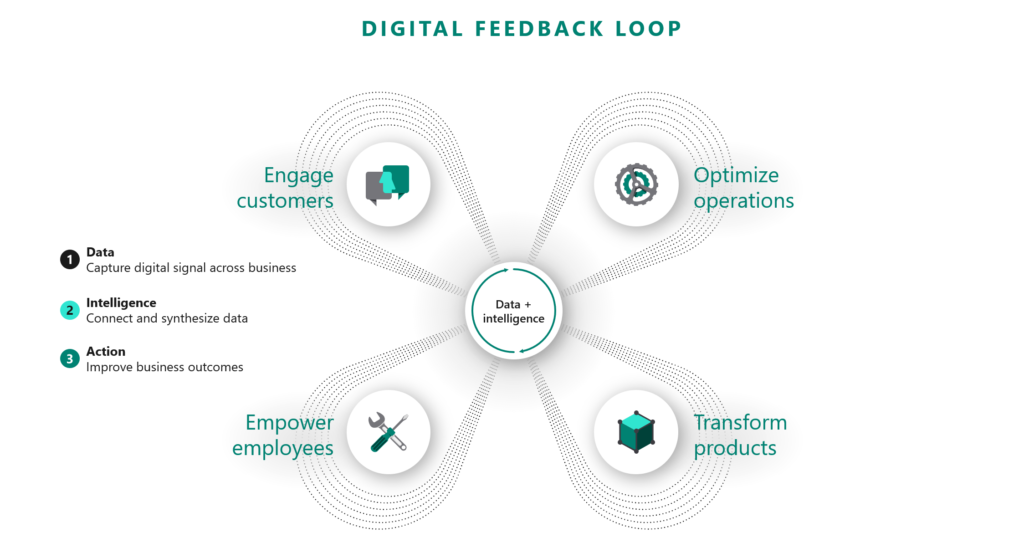

O’Keefe adds; “Enterprise needs to develop policies about data access and use, and a technology framework that is able to access the data, interpret the data and then use the insights to empower people and organisations to take informed action.

“Data is the missing link in organisations embarking on company-wide transformation. Fortunately, there are proven solutions that address the issue.”

Dynamics 365 and Power Platform backed by the Common Data Service for Apps, provides a flexible cloud-based solution that allows organisations to easily capture, access and apply their data broadly across the business.

Common Data Service for Apps allows organisations to securely store and manage data that is used by business applications- making that data available creates a digital feedback loop providing instant insights and intelligence to empower employees to drive action.

Organisations that implement a digital feedback loop, for example have the ability to easily bring data from their operational processes and customer interactions to understand key metrics like wait times and customer dissatisfaction that allows them to react quickly, drive change and provide better customer experiences.

Subtle differences across sectors

The study focussed on three areas; retail, finance and government. While the overarching themes and intent of transformation resonated for all, there were some subtle differences.

For example, government was keenest to optimise operations, while the primary focus for finance firms was empowering employees. Not surprisingly, engaging customers was the number one transformation priority for retail businesses.