Built in the cloud

How emerging UK fintechs are using technology to revolutionise banking

If you made a list of the UK’s major banks 10 years ago, it would be relatively short. Part of the reason for this is due to the large amounts of capital required, fees and regulations that were involved with setting up a new financial institution. However, when the 2008 financial crisis rocked the world, things began to change.

As UK banks were bailed out and a recession took hold, it became apparent that the financial sector needed to change. More diversity would provide greater resilience and stability, contributing to recovery and growth in the economy. New bodies such as the New Bank Start-up Unit were established, allowing the sector to open up to new players.

Today, the banking industry is undergoing rapid digital transformation, beyond the apps and website features that customers are now used to. Traditional banks are competing with startups and industry disruptors which, within a short space of time, are offering innovative, digital features, centred around customer needs. Their businesses are supported by platforms such as Microsoft Azure, which enables them to transform customer experiences, simplify regulatory compliance and utilise cloud resources to quickly and efficiently scale their services according to demand.

This drive for innovation is made possible by new tools and technologies, ushering in an era of groundbreaking financial services that place the customer first. In the UK, several key players are spearheading this financial revolution, using technology to compete with traditional providers that have large customer bases and established revenues.

Driven by the cloud

At their core, fintechs harness the power of technology, often offering customers digital-first services. While parts of the banking sector have adopted technology, many are still rooted in tradition. Many challenger banks have the advantage of being born in the cloud with technology and innovation firmly in mind. Their business and technology strategies are closely linked.

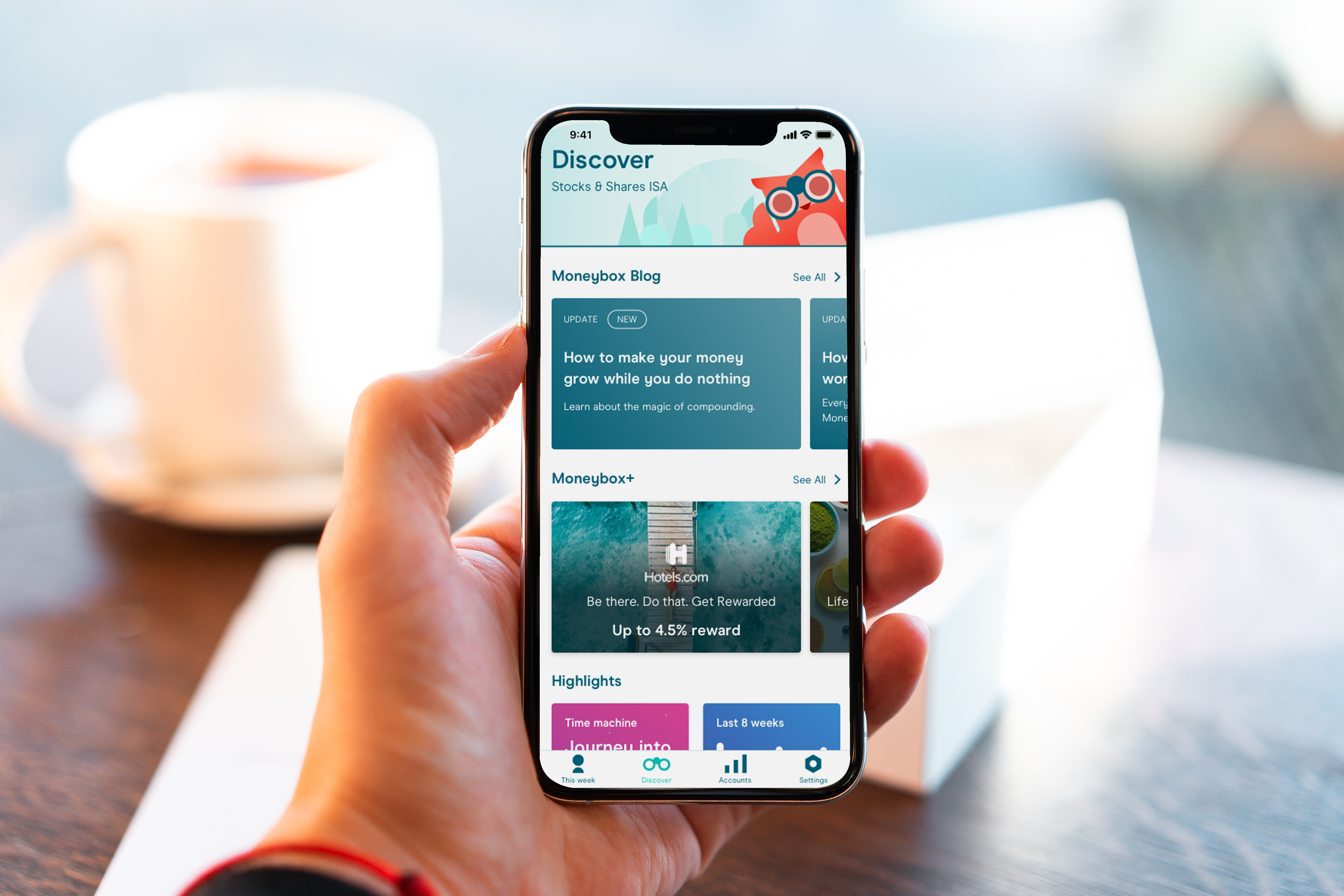

Moneybox is one example of a growing UK fintech. Based in London, the Moneybox app offers a range of investment and savings products, including stocks and shares ISAs, Lifetime ISAs and personal pensions. Made famous through its trademark round-ups feature, which helps you save your spare change, Moneybox makes it easy to get started and offers the products and tools to suit every need; whether you’re saving for your first home or just a rainy day. Moneybox has around 600,000 customers in the UK, with £1.2 billion-worth of assets under administration, and is one of the fastest-growing tech companies in the UK.

Efficiently and securely processing the huge amounts of data that comes with new users and their preferences is far from easy. Managing an infrastructure and scaling up services to meet demand pose considerable challenges for any business, let alone one that must constantly remain security compliant and adhere to strict financial regulations. Having previously spent precious time and resources on hiring expensive DevOps teams with unsatisfactory results, Moneybox decided to build its business on Microsoft’s Azure cloud computing platform.

Efficiently and securely processing the huge amounts of data that comes with new users and their preferences is far from easy. Managing an infrastructure and scaling up services to meet demand pose considerable challenges for any business, let alone one that must constantly remain security compliant and adhere to strict financial regulations. Having previously spent precious time and resources on hiring expensive DevOps teams with unsatisfactory results, Moneybox decided to build its business on Microsoft’s Azure cloud computing platform.

“Everything is run on the Azure platform,” says Jon Leigh, Technology Director at Moneybox. “Having Microsoft take care of the tech operations side of things and managing our infrastructure means that we don’t have to worry about crucial things like scaling, security and backing up our resources. Ultimately, this means that we can focus on doing what we do best – devoting our time to building new features for our customers.”

Being able to focus on its product roadmap means that Moneybox can draw in new customers while improving the experience of existing ones, all without having to worry about its systems coping with the growth in demand or compromising the stability of its services. As well as being able to automatically scale to meet that demand, Azure also ensures that Moneybox pays only for the resources used, increasing efficiency and reducing costs in the process. Given the value of developer time and the importance of customer satisfaction, the Azure platform plays a vital role in Moneybox’s success.

Addressing a vital market

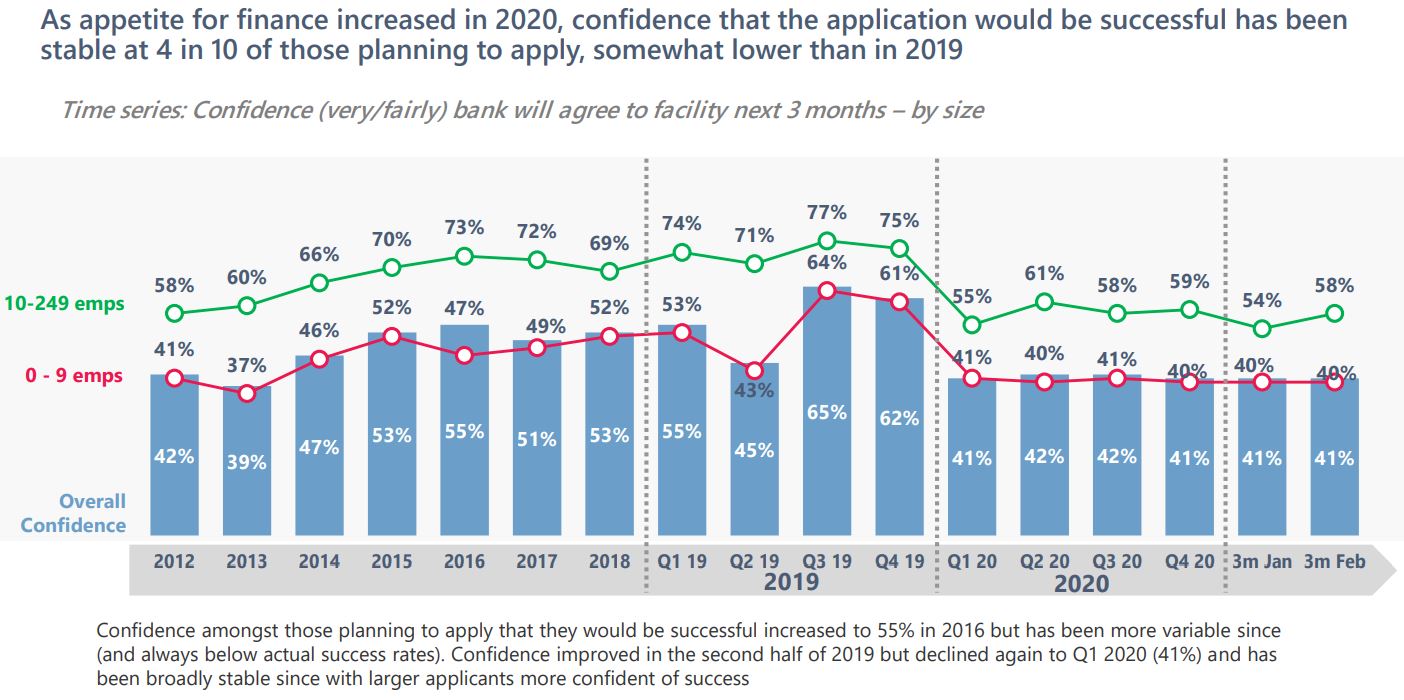

The time freed up by Azure’s platform can, in itself, also form the very backbone of an entire business model. Since the financial crisis, small and medium-sized enterprise (SME) funding has been more difficult to secure. According to an SME Finance Monitor report, appetite for finance increased in 2020 but confidence that the application would be successful has remained flat at four in 10 of those planning to apply, somewhat lower than in 2019.

Albaco is a Glasgow-based fintech bank that aims to address this UK funding gap for SMEs, which, despite the lower loan success rate, still contribute trillions of pounds to the UK economy. The company’s primary focus is to build close relationships with SMEs to offer bespoke financial services tailored to their needs, which is something that traditional banks can struggle with. Without the time and resources freed up by using Azure as its platform, there would be less time available to focus on building these key relationships and meeting customer needs.

Albaco is a Glasgow-based fintech bank that aims to address this UK funding gap for SMEs, which, despite the lower loan success rate, still contribute trillions of pounds to the UK economy. The company’s primary focus is to build close relationships with SMEs to offer bespoke financial services tailored to their needs, which is something that traditional banks can struggle with. Without the time and resources freed up by using Azure as its platform, there would be less time available to focus on building these key relationships and meeting customer needs.

“These businesses aren’t getting the financial help and support they need in order to help them grow,” says Craig McKellar, Head of IT at Albaco. “Incumbent banks tend to use ‘one size fits all’ lending models in the decision-making process, which often don’t take into account the varied stages and situations that SMEs can be in. It’s a process that’s cumbersome, and a hindrance. We want to build a relationship with SMEs and be a part of their journey as they grow, taking into account all the different facets when making a lending decision.”

Capital on Tap is a fintech business focused on helping smaller businesses thrive. It provides SMEs with a business-focused credit card that offers higher limits than regular consumer options while still being more accessible than larger corporate offerings. Around 90% of applicants get an instant application decision within a minute thanks to the foundation built on Microsoft Azure. This compared well with traditional applications, which can see customers waiting a week or more for a decision.

Capital on Tap is a fintech business focused on helping smaller businesses thrive. It provides SMEs with a business-focused credit card that offers higher limits than regular consumer options while still being more accessible than larger corporate offerings. Around 90% of applicants get an instant application decision within a minute thanks to the foundation built on Microsoft Azure. This compared well with traditional applications, which can see customers waiting a week or more for a decision.

“We looked at Amazon and Google, but when we dived deeper into the Azure platform it seemed like a really good match for us,” says Jamie Howard, CTO at Capital on Tap. “Azure’s event-driven architecture lets us create push notifications for our customers so they know immediately when payments go through. Scaling is another important reason we went with Azure. We can scale up and down as the need changes, which came in very useful during the pandemic as business slowed down and then picked up again.”

Allowing customers to instantly receive feedback on their application and accounts is a unique benefit that allows Capital on Tap to provide a smooth, reliable and helpful service for its customers.

Regulation and security

Starting a bank is an expensive, time-consuming process. It requires a comprehensive business plan while working in conjunction with the Bank of England. The plan has to be robust and resilient, from both an operational and financial perspective, and there are numerous compliance and regulatory stages to be cleared before a banking license is issued. Selecting a cloud provider that has a comprehensive understanding of the workings and regulations of the financial world can therefore greatly assist in these early stages.

Azure offers the broadest compliance coverage of any cloud provider, with a dedicated service for financial services compliance. It provides support for the right to audit, transparency in operations, automated audits and self-reporting. It also unifies security management, providing a robust set of tools to help protect against financial crimes. Microsoft has also published a guide that details how Azure can help financial services customers that are authorised by the UK Financial Conduct Authority (FCA) and the Prudential Regulatory Authority (PRA) when moving their IT operations to the cloud.

“We were drawn to the way Microsoft worked with Redwood Bank, the first bank of its kind in the UK to be born in the cloud,” McKellar states. “Microsoft was keen to deliver its strategy to the UK regulators, addressing questions and requests and feeding these into its product and service offerings. This sent really strong signals to us. This is a market Microsoft is clearly knowledgeable in, wants to be involved in and takes very seriously.”

To receive authorisation from the FCA, banks must demonstrate that their systems are secure and robust. With strict financial regulations, ever-changing privacy laws and a shifting technology landscape, it would be an incredibly difficult task for new banks to constantly keep on top of everything with an on-premise solution.

When data is no longer needed, for example, banks can archive it for compliance or audit trail purposes in accordance with banking regulations. There can be privacy issues with data kept in storage for years, but Azure provides compliant options for storing and accessing such data. Storing data in the cloud also offers a more resilient, cost-effective solution. To remain compliant with banking regulations and data protection policies, data also often has to be deleted when it’s no longer needed. A sensible strategy for permanently removing unwanted data is to do so on an interval, nightly or weekly basis. This can easily be set up on Azure for peace of mind.

“Having our platform and data on Azure means that we remain compliant with data protection and FCA laws,” Leigh adds. “Everything’s automatically patched for us, too, so we know we won’t suffer any security vulnerabilities. Knowing it’s all taken care of helps us sleep at night.”

Microsoft’s approach to financial services compliance can also help challenger banks broaden their horizons. In early March, Capital on Tap announced the company will be expanding to the US, with the aim of supporting more than 10,000 businesses in the first year. Without Microsoft’s in-depth knowledge of compliance and regulatory procedures overseas, the expansion process would have taken much longer.

“What we found really useful was the security centre within Azure,” Jamie Howard explains. “In particular, we made use of the compliance and regulatory scanning features during our US expansion, as we were dealing with different types of regulation that we’ve experienced in Europe. This all comes out of the box with Azure, so it’s been very, very useful.”

Moneybox, Albaco and Capital on Tap are just a few examples of fintechs and financial services providers that have chosen to strengthen their services by using Azure. Earlier this year, Microsoft announced a new industry-specific cloud offering, Microsoft Cloud for Financial Services, which brings together industry solutions, templates, APIs and regulation and security standards to allow banks to scale and create the best possible service for their customers. From freeing up more time and focusing on customers, to the day-to-day operations and automatic security and compliance updates, the Azure cloud is powering new banks looking to make their mark on the world.