Leaders look to technology to help reinvent their business and compete

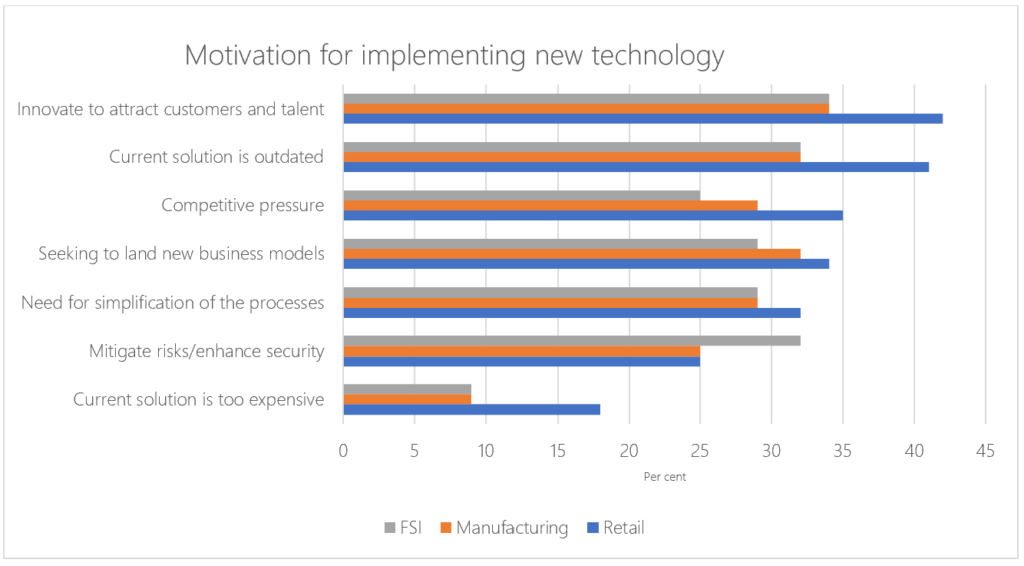

For over a third (39%) of businesses in Central and Eastern Europe (CEE), the primary motivation behind implementing new technology is the desire to better understand and attract customers, surpassing the need to replace outdated systems or simplify current solutions. As organisations move from responding to the effects of the pandemic to recovery and reimagination of business, innovation will matter even more to stay relevant, efficient and competitive.

In the CEE Digital Transformation Survey 2020, we asked medium-to-large businesses across the region why and how they are using new technology to drive growth and improve margins, focusing on three sectors: Retail, Manufacturing and the Financial Services Industry (FSI). The research started in February of this year, and was completed in May, after businesses had already experienced the impact of pandemics more fully. The majority of companies confirm they value technology as an important enabler for recovery and reinvention, saying they intend to maintain or even increase their IT investments after the peak of the pandemic is over.

RETAIL: Understanding customers through data

In the retail sector, the research identified two focus areas for innovation:

– data analytics to help better understand customers: almost a third of retailers in CEE consider it a priority; focusing evenly on analyzing the data customers share with them and implementing solutions to get a unified view on their customers’ needs.

– enhanced supply chains: a quarter of respondents are looking to use technology to ensure faster delivery timelines and more efficient inventory management.

For larger retailers, digital instore experiences and interactivity, designed to keep customers returning, was nearly double the priority compared to smaller retailers. As the current climate shifted most customer interactions to digital space, the focus on bringing them back to store will likely return over time, or even increase in importance.

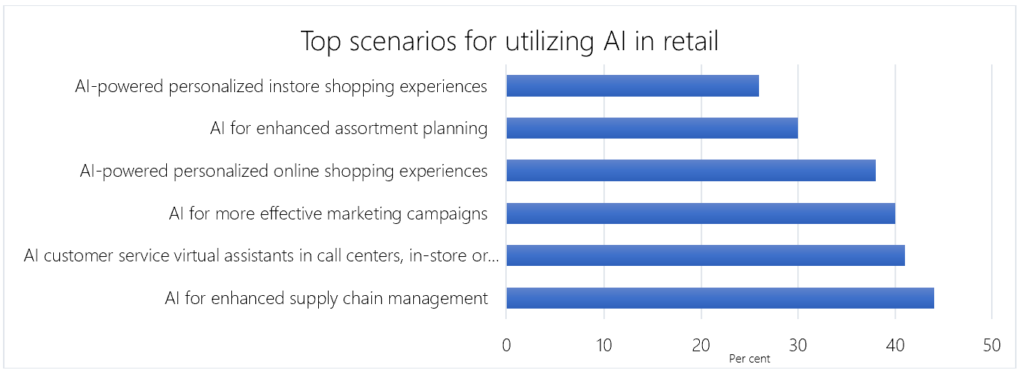

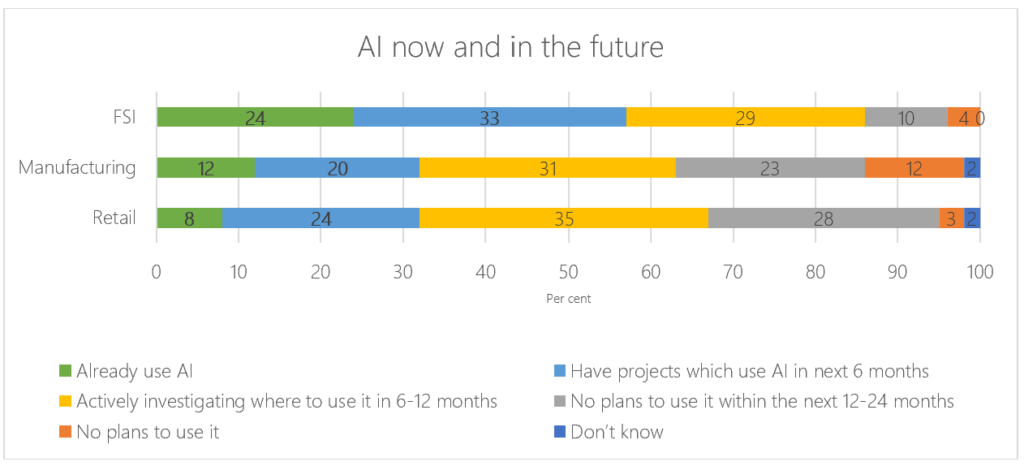

Advanced technologies have an important role to play for both top priorities. Two out of three retail companies said they planned to make AI a business priority in the next year with the top proposed scenario being enhanced supply chain management followed by improving customer interaction through solutions for personalized shopping experiences and marketing campaigns.

MANUFACTURING: Optimising supply chain

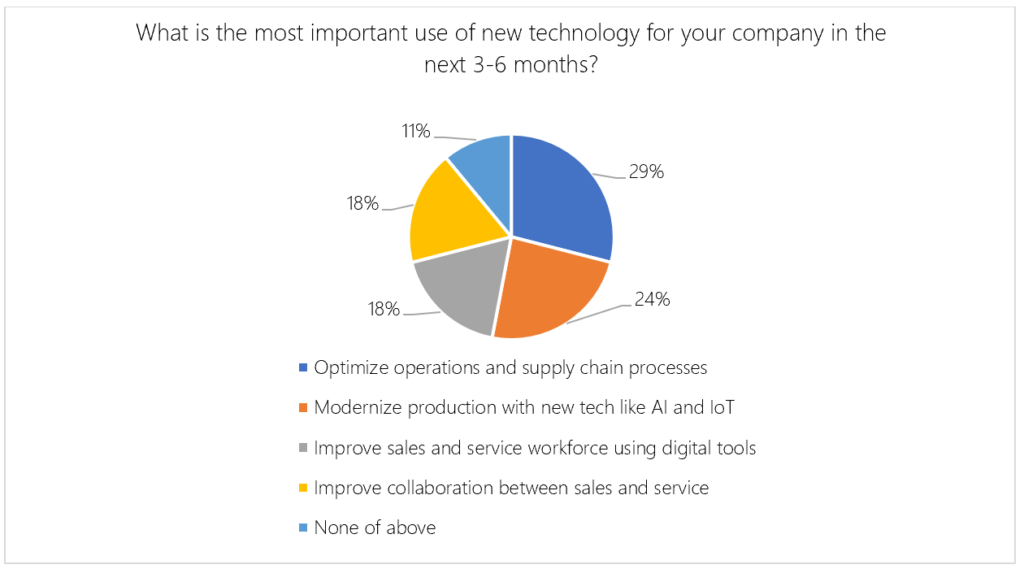

More than half of leaders in manufacturing want to modernize operations, production and the supply chain to stay competitive. Areas of focus include warehouse management, use of technology (e.g. sensors and ambience intelligence) to deliver the right product or service at the right time, capacity utilisation and customer demands forecasting. Over a third of manufacturers want to invest in technology that empowers employees within sales and service.

Intelligent technologies are already beginning to transform the manufacturing industry. Nearly two thirds (63 per cent) of all businesses in the region currently use AI or will do so within the next 12 months.

– AI-powered prediction is favored for helping optimize the maintenance schedules of equipment, in line with priorities they list as being important to them – minimizing downtime (68 per cent) and saving costs (56 per cent).

– Advanced technology also holds significant potential for creating autonomous supply chains which increase productivity and reduce waste – a priority for 55 per cent of manufacturing businesses in the region.

With almost twice as many smaller organizations saying competitive pressure is fueling their motivation to implement new technology, leveraging the right technology could be an important way to help them gain an advantage over others.

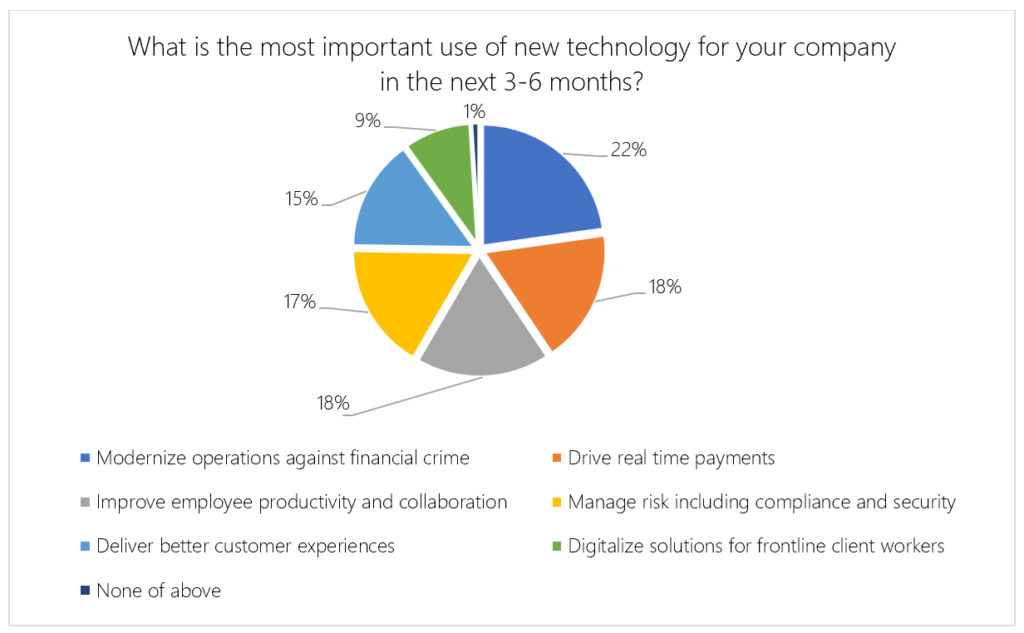

FSI: Advancing security

Using data analytics and intelligent technology to improve protection against financial crime and manage risks continues to be the priority for FSI companies. The industry is also looking to innovate across other key priorities, including real-time payments, increasing employee collaboration and improving customer experience.

The findings reinforce FSI as one of the most tech savvy sectors, with 86 per cent of organizations already using AI or planning to use it in the next 12 months.

– The technology pertains to two key scenarios: fraud and risk management and a growing role in customer engagement.

– Virtual assistants to understand and respond to customer needs feature as the primary expected investment (54 per cent); AI-powered targeted marketing is also expected to be a priority (43 per cent), as is personalized human customer service augmentation (42 per cent).

– When it comes to risk management, FSI organisations look to technology especially to help address cybersecurity and credit scoring.

Compared to their bigger peers, smaller banks rely even more on advanced technology to enable targeted marketing leading to improved cross-sell and up-sell (48 per cent vs 29 per cent).

Nearly three quarters (71 per cent) of businesses in CEE believe that the technology is going to play an important role in their industry in the near future.

*The research was conducted in February 2020 in Central and Eastern Europe with 815 companies with over 100 employees. The retail questions were answered by respondents in Czech Republic, Greece, Hungary, Poland, Romania, Russia and Ukraine. While the manufacturing and FSI questions were answered in Russia, Poland and Czech Republic only. Respondents spanned ITDM or BDM positions.