Connie Leung, senior financial services industry director, Microsoft Asia shares how Blockchain technology, identified by the World Economic Forum as one of the top 10 emerging technologies, will transform the industry

Today, the adoption of blockchain technology by banks and big companies is moving ahead at an unprecedented speed. As a decentralized digital ledger of transaction, a blockchain is essentially a data structure which can be shared among a distributed network of computers and this technology is literally changing the way businesses are conducted.

Today, the adoption of blockchain technology by banks and big companies is moving ahead at an unprecedented speed. As a decentralized digital ledger of transaction, a blockchain is essentially a data structure which can be shared among a distributed network of computers and this technology is literally changing the way businesses are conducted.

Interestingly, the World Economic Forum [1] recently placed blockchain technology as one of the top 10 emerging technologies of 2016. According to the report, the economic and social impact of blockchain’s potential to fundamentally change the way markets and governments work is only emerging.

It comes as no surprise that financial institutions are increasingly realizing the potential of blockchain to alter shared practices between customers and suppliers. As a matter of fact, incumbent financial institutions are investing in building permissioned blockchains to streamline their own operations and costs.[2]

Asian Banking and Finance Industry: On the Cusp of Transformation

Across the Asia Pacific region, organizations are increasingly realizing the potential in securitization of physical assets resulting in growing blockchain investments. Today, banks in the region are investigating the use of blockchain technology in areas such as intrabank transfers, international payments and trade finance.[3]

There are three factors contributing to the growth of this technology starting with Market Opportunity, Talent Scenario and Right Infrastructure.

The market opportunity is huge in Asia, considering Hong Kong and Singapore being the two key financial hubs, which are also massive shipping and trading magnets. Due to the intersection of international trade and the ability to accelerate competition and innovation, there is tremendous potential for this technology to take off.

Trade finance is certainly an area where Blockchain initiatives have taken off globally and in Asia. For instance, the Infocomm Development Authority of Singapore (now known as GovTech) announced last December ‘the world’s first application of distributed ledger technology in trade finance,’ in conjunction with Standard Chartered Bank and DBS Bank.[4]

Since then, we have seen many announcements on trade finance blockchain proof of concepts in Asia amongst banks such as HSBC and Bank of America between Hong Kong and Singapore [5] ; as well as the first cross-border transaction between Commonwealth Bank of Australia and Wells Fargo & Co using multiple blockchain applications, resulting in a shipment of cotton to China from the United States. [6]

At Sibos 2016, Microsoft Treasury also announced a Proof of Value blockchain technology collaboration with Bank of America Merrill Lynch to digitize and automate trade finance processes, shorten transaction settlement times, offer more predictable working capital and reduce counterparty risk for both banks and customers. [7]

Trade finance, due to its nature of multiple parties involved and the manual paper processing where blockchain offers tremendous benefits in digitizing the processes, we will continue to see market demand on blockchain solutions. In addition, Hong Kong Monetary Authority at the Fintech Festival event in Hong Kong on Nov 11 announced its first Distributed Ledger Technology white paper indicating how blockchain can help financial institutions in mortgage, trade finance and identity management. [8]

In fact, Japan’s Bank of Tokyo-Mitsubishi UFJ (MUFG), SBI Sumishin Net Bank, Mizuho Bank, South Korea’s KB Kookmin Bank and Shinhan Bank have all entered the blockchain space. [9]

Talking about the talent set-up, there is no denying that there is a huge banking and financial skillset in Singapore and Hong Kong. However, we do see a talent challenge in the market and for blockchain to be widely adopted, the key is to get banking industry and developers introduced to blockchain technology and technology providers to drive solutions. In effect, one will see a lot more start-ups coming into the blockchain space.

And thirdly, the right infrastructure is essential, given the fact that having a common technology infrastructure that meets regulatory requirements is a necessity.

We are seeing regional governments open up to this concept as well as provide support in some cases. The industry is also seeking regulators’ support and guidance on this technology. In fact, the Monetary Authority of Singapore (MAS) has announced a partnership with R3[10] on a proof-of-concept project to conduct interbank payments leveraging Blockchain technology.

It is undeniable that the region’s banking sector is showing growing enthusiasm for the technology’s disruptive potential.

Understanding the Benefits

There is a general notion that blockchain technology is going to eliminate banks. But this is just not possible as one cannot get rid of liquidity risk management and then tie it to central banks. Ultimately, central banks are needed when one needs to build big industries and there is a need for capital.

Some of the key benefits of blockchain technology include:

- Eliminating the need for third-party validators

Blockchain technology will destroy certain types of correspondent banking, clearing houses and middlemen, contract executors, payment processors, and brokers. Services and institutions that act as middlemen to facilitate and verify financial transactions, contract relationships, record-keeping and asset transfers could all be disrupted by blockchains, by offering a cheaper, faster and more secure way of doing business.

- Modernizing legacy banking infrastructures

Advancement in any industry is measured in decreased time spent and increased efficiencies. With Blockchain technologies, the opportunity to advance both dials are possible namely by addressing the settlement process across the board for financial services. Speeding payments, trading of all financial instruments and automatically outputting regulatory information will massively disrupt the industry and shift labor into better servicing of customers.

- Securing Transactions

Blockchain technology offers promise for secure transaction on the back of it being an encrypted ledger that cannot be manipulated and helping address cyber threats most directly by establishing authenticity and tamper proof systems of record. Decentralization of the command systems and the distributed nature of blockchains are the critical elements to ensure cyber security. [11]

Leveraging Blockchain as a Service Potential to the Fullest in Asia

No one is taking the blockchain ecosystem more seriously than banks.

It is important for banks to learn what distributed ledgers can and cannot do, how they can fit into existing system and how they could disrupt those systems. Reading about what blockchains can do holds little value compared to having hands on institutional knowledge for how to actually perform some of these innovations. Discovery of opportunities in the marketplace will come more rapidly with hands on experience.

Microsoft is building an ecosystem that allows participants to quickly learn about blockchain technologies and to experiment and innovate quickly and cost-effectively. Microsoft Azure Blockchain as a Service (BaaS), which was launched last November, delivers the galaxy’s largest blockchain sandbox for consortiums like R3 and its members to evolve in a cost-effective manner.

Since then, we have expanded our eco system with many more partners and we have seen many different instances of blockchain testing in our labs. Mizuho Financial Group has created a proof of concept to validate how effectively Azure BaaS can be implemented for their syndicated loan operations using Ethereum based smart contract. In Taiwan, AMIS, the first blockchain technology provider for financial institutions was established. Their solutions utilize the BaaS capabilities of Microsoft Azure. [12]

Many of the initial blockchain projects are in proof-of-concept stage for banks to learn and understand the benefits of this technology. These will soon need to evolve into a scalable pilot/production service taking into consideration security, scalability, onboarding and interface into bank’s existing system.

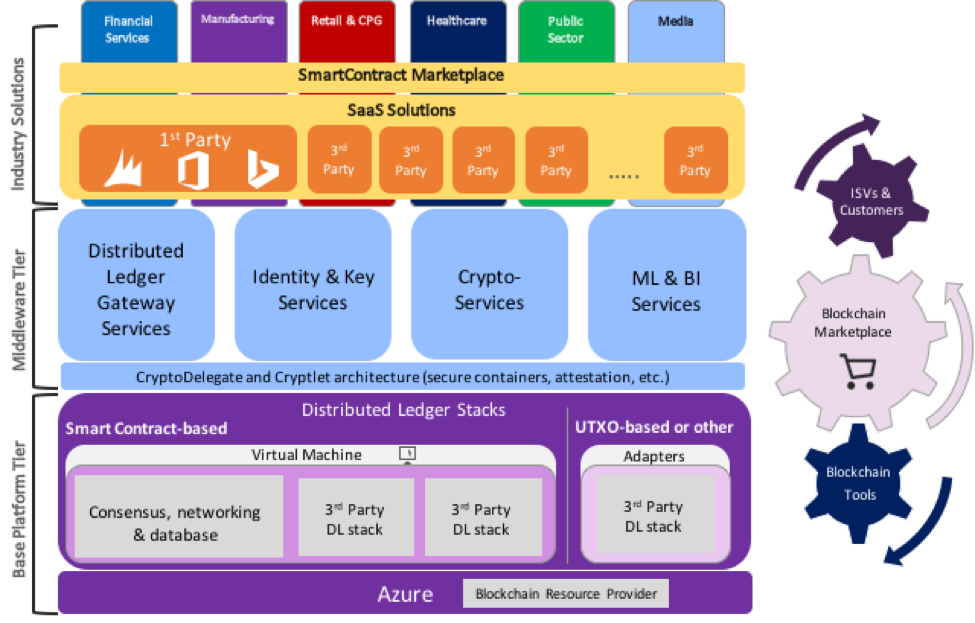

At the DevCon2 event in Shanghai in September, Microsoft introduced Project Bletchley – Microsoft’s vision for an open, modular blockchain fabric powered by Azure, and highlights new elements we believe are key in enterprise blockchain architecture with the introduction of middleware layer and “cryptlets’.

According to Marley Gray, Director Business Development & Strategy Cloud + Enterprise at Microsoft, “blockchain middleware will provide core services functioning in the cloud, like identity and operations management, in addition to data and intelligence services like analytics and machine learning. These technologies will ensure the secure, immutable operation that blockchain provides.”

“Cryptlets, a new building block of blockchain technology, will enable secure interoperation and communication between Microsoft Azure, ecosystem middleware and customer technologies. Cryptlets function when additional information is needed to execute a transaction or contract based on a date or time and providing market data. They will become a critical component of sophisticated blockchain systems, enabling all technology to work together in a secure, scalable way,” he further added.

Using Microsoft Azure Blockchain as a Service (BaaS), with multiple Blockchain partners such as smart contract platforms Ethereum, Eris, and Tendermint, R3 created a peer-to-peer distributed ledger that connects many of the consortium’s leading banks including Barclays, Credit Suisse, HSBC, Royal Bank of Scotland, Citi, Bank of America, and Wells Fargo. In a first test of the distributed ledger, the banks simultaneously simulated financial transactions.

Using Microsoft Azure Blockchain as a Service (BaaS), with multiple Blockchain partners such as smart contract platforms Ethereum, Eris, and Tendermint, R3 created a peer-to-peer distributed ledger that connects many of the consortium’s leading banks including Barclays, Credit Suisse, HSBC, Royal Bank of Scotland, Citi, Bank of America, and Wells Fargo. In a first test of the distributed ledger, the banks simultaneously simulated financial transactions.

As we continue to support our industry and building the partner eco systems, KPMG Singapore recently announced their Digital Ledger Services with our partner BaaS services to address the growing demand of the customers in the region for Blockchain. [13]

In today’s “fail fast” environment, if you are not failing then you are not trying. And if you are not trying, then you are not innovating. Financial services industry is often viewed as slow in technology adoption and innovation. Given the current disruptive business environment, many banking and financial institutions are in the digital transformation process.

We have seen 2015 being the distributed ledger year, 2016 is the proof of concept year, and the industry is expecting 2017 to be the pilot year. We are witnessing more industry collaboration and regulators evaluating the blockchain technology and we will see faster adoption of technology and Blockchain-as-a-service is one significant channel to transform in this disruptive world.

[1] https://www.weforum.org/agenda/2016/06/top-10-emerging-technologies-2016/

[2] http://www.the-blockchain.com/docs/Morgan-Stanley-blockchain-report.pdf

[3] http://www.ey.com/Publication/vwLUAssets/EY-banking-in-asia-pacific/$FILE/EY-banking-in-asia-pacific.pdf

[4] https://www.ida.gov.sg/About-Us/Newsroom/Media-Releases/2015/Singapore-demonstrates-Worlds-First-Application-of-distributed-ledger-technology-in-Trade-Finance

[5] https://www.finextra.com/newsarticle/29288/bank-consortia-look-to-distributed-ledgers-and-smart-contracts-to-rewire-trade-finance

[6] http://www.reuters.com/article/us-australia-tech-banks-idUSKCN12O0DX

[7] https://news.microsoft.com/2016/09/27/microsoft-and-bank-of-america-merrill-lynch-collaborate-to-transform-trade-finance-transacting-with-azure-blockchain-as-a-service/#sm.000o4j15j1d7jdsdvlz2qjtmxa7kj

[8] http://www.hkma.gov.hk/media/eng/doc/key-functions/finanical-infrastructure/Whitepaper_On_Distributed_Ledger_Technology.pdf

[9] http://www.coindesk.com/7-asian-banks-investigating-bitcoin-and-blockchain-tech/

[10] http://www.mas.gov.sg/News-and-Publications/Media-Releases/2016/MAS-experimenting-with-Blockchain-Technology.aspx

[11] https://news.bitcoin.com/blockchainn-next-defense-cyber-security/

[12] https://news.microsoft.com/zh-tw/2016-10-28_%E5%BE%AE%E8%BB%9F%E6%94%9C%E6%89%8Bamis%E5%85%AC%E5%8F%B8-%E6%8E%A8%E4%BA%9E%E6%B4%B2%E9%A6%96%E5%80%8B%E8%81%AF%E7%9B%9F%E5%8D%80%E5%A1%8A%E9%8F%88%E5%AF%A6%E4%BD%9C%E2%94%80%E3%80%8C/#sm.000o4j15j1d7jdsdvlz2qjtmxa7kj#SfxMmK9kk3UMYl2u.97

[13] https://home.kpmg.com/sg/en/home/media/press-releases/2016/11/kpmg-launches-digital-ledger-services-to-help-companies-implement-blockchain-technology.html