Asia Pacific, Singapore, 23 October 2018 — According to latest figures released today by Microsoft and IDC Asia/Pacific, region’s GDP stands to gain an extra US$292 billion if all FSI organizations in the region embrace digital transformation. This will add 1.5% growth annually (CAGR).

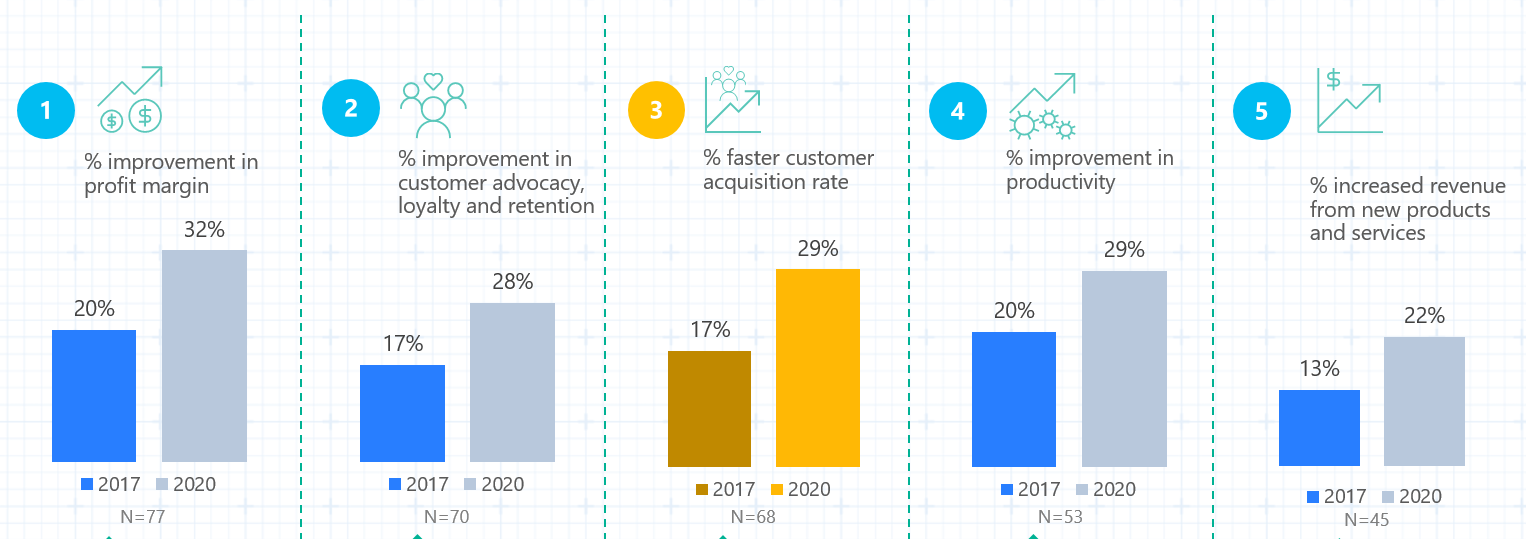

The Study, “Unlocking the Economic Impact of Digital Transformation in Asia Pacific[1]” found that that FSI organizations that have embraced digital transformation saw substantial impact to their business performance last year – 13% to 20% improvements in profit margins, productivity, customer advocacy, customer acquisition rates, and revenue from new products and services in 2017. In addition, they expect to add 70% more in customer acquisition rate by 2020.

“While 73% of FSI organizations in Asia Pacific have full or progressing digital transformation strategy in place compared to 55% of organizations in other industries, they need to accelerate their journeys to provide differentiated customer experiences,” said Connie Leung, Senior Director, Financial Services Business Lead – Asia, Microsoft.

“For years, FSI organizations have been primarily focused on maintaining operations to keep the lights on. This have weakened their touch on their customers. Today, with the rise of new emerging competitors and disruptive technologies, along with changing customers’ demographics, FSI organizations need to move from selling products to offering solutions, re-imagine new business models with speed and agility. Simply doing what has proved to work before is not acceptable in the new digital era. It is time to innovate and realize unique customer experiences that will be key to success,” added Leung.

According to the Study, FSI players recognize the need to embrace a customer-first approach to address the rise of new digital-first rivals entering Asia Pacific markets, especially disruptive fintech entrants. Increased number of competitors and the need to develop new business models were named among the top three business concerns for over 200 FSI business leaders who participated in the Study.

Their commitment to improve customer-centricity is proved by the strong focus to track customer advocacy as one of the top KPIs and to transform customer-facing business processes in 2018. 55% of respondents plan to improve their customer service and support.

Leveraging Data and AI to Create New Customer Experiences and Solutions

“Data is the new currency, and FSI organizations are realizing the importance of data insights in order to create new customer experiences. In fact, 48% of respondents pointed out one of their KPIs used to measure digital transformation today is tracking how data is being used as a capital asset within the business. As such, it is no surprise that the number one core technology FSI organizations will invest in this year is big data analytics, as this will support their AI, Cognitive and Robotics implementation,” said Victor Lim, Vice President IDC Asia/Pacific.

In fact, by 2019, IDC predicts that 40% of digital transformation initiatives will be supported by Artificial Intelligence/ Cognitive capabilities[2], providing timely, critical insights for new operating and monetization models in Asia Pacific (excluding Japan).

Leung said: “Without a doubt, AI will serve as the primary catalyst for future growth. Companies have accumulated mass quantities of structured and unstructured data and content over many years. It is time to tap on big data analytics, cloud and AI to turn this data into insights and knowledge, to improve on existing services, create innovative experiences, and ultimately developing new business models.”

An AI-driven bank can deliver better customer experiences by engaging people in a natural, highly personal, and innovative way; and helps to gain more loyalty and improve bottom line. However, the implementation of an AI strategy needs to be driven at the highest levels of the company. In addition, FSI organizations need to evaluate their strategies in two areas:

1. Develop an AI-ready culture

FSI business leaders need to address organizational shifts which includes moving away from siloed projects and focusing on enterprise-wide transformation. Organisations also need to encourage use of data across all processes and customer touchpoints, in building a knowledge ecosystem that will contribute to the development of new digital products and services.

2. Develop capabilities to adopt and execute on AI

Beyond a technological transformation, FSI business leaders need to build talent capabilities as well as integrate ethical design of AI solutions within their operations

In Australia, the National Australia Bank (NAB) and Microsoft have collaborated to design a proof of concept Automatic Teller Machine (ATM) using cloud and artificial intelligence technology.

The cloud-based application, developed using Azure cognitive services, has been designed to improve the customer experience by removing the need for physical cards or devices to access cash from ATMs. Instead, a customer who opts into the service is able to withdraw cash from an ATM using facial recognition technology and a PIN. The system does not store images, only the biometric data, and the data is held securely on Microsoft’s trusted cloud platform.

The likely impact of data and AI resonates keenly for NAB Chief Technology and Operations Officer Patrick Wright who met with thought leaders, including senior Microsoft executives, during a US study tour earlier this year. “It just reinforced to me the need for banks to be simpler and faster for our customers; we want to deliver great connected customer experiences,” Wright shared.

To read more about how NAB and Microsoft is working together click here.

At Sibos 2018, Microsoft and partners will showcase new solutions alongside partners, as well as announce industry programs designed to help FSI businesses to transform in the digital era. For more information, visit https://enterprise.microsoft.com/en-us/ms-events/industries/banking-and-capital-markets/microsoft-at-sibos-2018/ or visit the Microsoft Official Blog.

[1] Unlocking the Economic Impact of Digital Transformation in Asia Pacific conducted with 1,560 respondents in 15 markets:

- 15 Asia Pacific markets were involved: Australia, China, Hong Kong, Indonesia, India, Japan, Korea, Malaysia, New Zealand, Philippines, Singapore, Sri Lanka, Taiwan, Thailand, and Vietnam.

- 211 respondents were from the FSI sector

- Business and IT leaders from organizations with more than 250 staff were polled.

- Industries polled included education, financial services, government, healthcare, manufacturing, and retail.

- Respondents are decision makers involved in shaping their organizations’ digital strategy.

[2] IDC, IDC FutureScape: Digital Transformation 2018 Predictions – Asia/Pacific (Excluding Japan) Implications