By Connie Leung, Senior Director, Financial Services Business Lead – Asia, Microsoft. This article was first published on Fintech Innovation.

There is a saying that goes “the customer is always right.” Customers obviously prefer to deal with their businesses of choice that assure both good service and products. This is especially true with the FSI industry, where beyond smart investments and transactions, customers build long-term, trusted relationships with their preferred banks or insurers.

For years, however, FSI organizations have focused on addressing operational pressures with a view to ensure profitability of the business. According to our latest study, Unlocking the Economic Impact of Digital Transformation, the top business concerns among FSI business leaders in the region include the need to develop new business models, and rising costs of operations.

While industries such as manufacturing and retail can compete on price and product, FSI organizations are trying to stay away from the same. To carve their niche in a highly competitive market, they need to realize that delivering differentiated customer experiences is key.

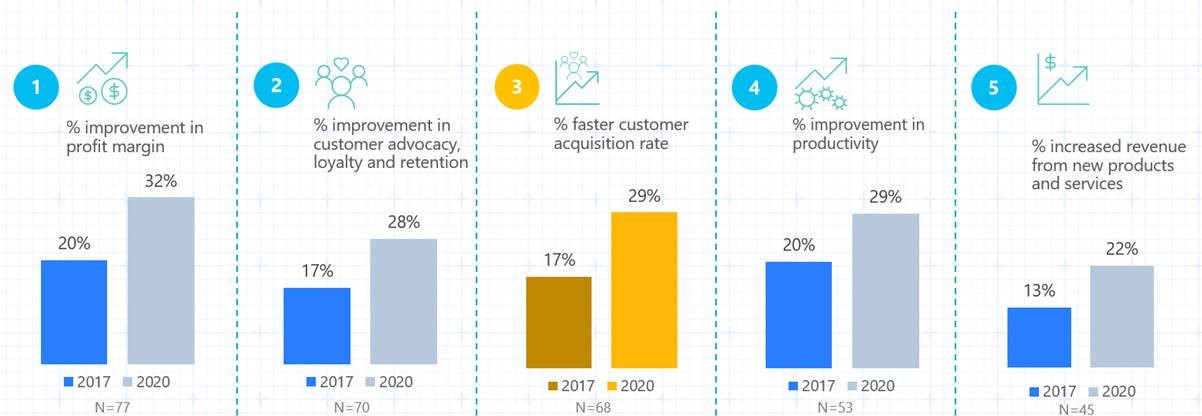

Organizations that have already embarked on their digital transformation journeys are seeing 13% to 20% improvements in key benefits gleaned. This includes higher profit margins, improved customer advocacy, and faster customer acquisition rates. Businesses also expect an additional 70% improvement in customer acquisition rate by 2020, underscoring the beneficial outcomes that embracing digital transformation brings to the table.

Digital Transformation for Customer Centricity

FSI organizations in Asia Pacific are aware of the need to digitally transform, with 73% of industry players having a full or progressing strategy in place, compared to the regional average of 55%.

However, digital transformation goes far beyond implementing a digital layer to existing products and services.

FSI organizations need to move from selling products to offering solutions, and by re-imagining new business models with speed and agility. Simply doing what has proved to work in the past is not acceptable in the new digital era.

What we are seeing today is a shift in mindset, where addressing customers’ needs is now a priority. More than half the FSI organizations (55%) polled highlighted that they will be focused on transforming customer service and support this year as part of their digital transformation initiatives. In addition, FSI organizations are concentrating on measuring customer advocacy as one of their top KPIs.

Data and Knowledge are Key to Unlocking Digital Transformation Potential of FSI Organizations

Digitalization of FSI services should focus on turning the customer journey into something personal, rather than utilitarian. Financial services should work seamlessly as part of the lifecycle of a transaction. It should be an end-to-end journey, from transacting on mobile devices, understanding your financial status through self-service analytics tools, to interacting with financial consultants.

Over the years, FSI organizations have accumulated mass quantities of data. It is time to tap on big data analytics, cloud and AI to turn this data into insights and knowledge. It will allow to improve on existing services, create innovative experiences, and ultimately develop new business models.

To do so organizations need to ensure they have a three-step data process for knowledge mining in place:

- Step 1: Collection of Data to create a Data Estate

FSI organizations first need to have a data strategy in place to make the most sense of structured and unstructured data.

- Step 2: Turning data into insights and knowledge

Organizations can build a knowledge base to optimize and personalize existing financial services through the use of data and advanced tools such as big data analytics, machine learning and AI. - Step 3: Creating new experiences, solutions and business models

Ultimately, this knowledge should be used to continuously create new experiences, services and solutions. For example, smart banking, intelligent consulting and enabling open banking APIs for organizations and fintech institutions to collaborate in developing a new generation of products. FSI organizations can also tap on knowledge mining to unlock valuable information lying latent – enabling them to view, predict and action on trends identified.

Australia-based Perpetual Corporate Trust, has developed a cloud-based data analytics platform that can act as an early warning signal for mortgage market hotspots.

Australia-based Perpetual Corporate Trust, has developed a cloud-based data analytics platform that can act as an early warning signal for mortgage market hotspots.

Perpetual’s Mortgage Market Insights module, developed using Microsoft Azure cloud services and Power BI, allows banks and financial service providers to analyse the performance of their own portfolio and benchmark against the greater than $200 billion Australian mortgage market.

It uses modelling to predict the future performance of the mortgage market and enables millions of lines of data to be processed at the click of a button. The platform utilizes machine learning so the predictive capability will continue to improve over time.

Perpetual’s cloud-based platform offers data analytics services and tools to support strategic business decisions, risk management, regulatory reporting and portfolio management through predictive algorithms and dynamic analytics – providing detailed data driven insights never seen before in the Australian market.

Artificial Intelligence: A Digital Transformation Enabler

It is no surprise that the study found that FSI organizations are looking at investing in big data analytics and cloud computing as core technologies for digital transformation in 2018. These investments also form the foundation in unlocking the potential of their AI investments.

Without a doubt, AI will serve as the primary catalyst for future growth of the sector. AI can help deliver better customer experiences by engaging people in a natural, highly personal, and innovative way; and helps to gain more loyalty and improve bottom line.

An AI-transformed bank can deliver positive impact in 4 areas: customer experience, new business models, risk management and regulatory compliance and lastly in tackling cyber security and financial crime.

However, the implementation of an AI strategy needs to be driven at the highest levels of the company. FSI organizations also need to also evaluate their strategies on two fronts: Culture and Capabilities:

- Focus on developing an AI-ready culture

To be successful in digital transformation, FSI business leaders need to address organizational shifts which includes moving away from siloed projects and focusing on enterprise-wide transformation. Organisations also need to encourage use of data across all processes and customer touchpoints, in building a knowledge ecosystem that will contribute to the development of new digital products and services. - Develop capabilities to adopt and execute on AI

Beyond a technological transformation, FSI business leaders need to build talent capabilities as well as integrate ethical design of AI solutions within their operations.